The subject of income verification is a bit like the off-side rule; initially it appears to be pretty straight forward, but it often can end up being a subject of great debate.

Income verification is a central part of an adviser’s sales process; it helps satisfy the regulatory requirement to know your customer, it demonstrates an understanding of financial crime and anti-money laundering risks, it helps to prevent fraud and engenders better relationships between lenders and advisers. But paramount is that it contributes toward good consumer outcomes, ensuring that advisers sell products that are affordable to clients. The mortgage market review also introduced a need for future affordability to be given appropriate consideration.

I’m sure you have heard many times and from many sources the importance of obtaining proof of income, but here are a few reminders regarding income verification:

- 3 Months’ worth of Payslips (minimum) – It may be appropriate to obtain more payslips if you have any suspicions. Also, don’t be afraid to ask for preceding payslips (i.e. those prior to the three months you already have); Lloyds Banking Group notes that this is an excellent way of spotting fraudulent payslips – In particular, watch out for delays in providing these documents.

- 3 Months Bank Statements – Obviously, make sure that these correlate with the payslips, therefore the salary credit must be clear on uploaded statements. Pay particular attention to the payment route and the account from which the funds have been sent. Evidence has been seen of clients sending money from one of their accounts to another of their accounts to make it look like a salary credit – beware of faster payments!

- Employer Due Diligence – Phone calls, internet searches, even a ‘Streetview’ of the business premises will help to confirm that an employee works at a specific place.

- Additional Income Sources – Please also ensure that all additional sources of income are verified (i.e. working family tax credit, pension payments, and any additional employment or self-employment).

But what about the self-employed?

Some lenders will accept tax calculations, some will accept accountant’s references, some SA302s, some will accept accounts and still others may request a selection of the above. As a network we appreciate that it can be challenging to satisfy the requirement to verify client incomes where the client is self-employed, however, we require the following on each self-employed client file:

| Sole Trader | 3 years HMRC Tax Calculation (SA302) or Accounts. |

| Ltd. Company | 3 years Accounts and HMRC Tax Calculation SA302. |

| Retained Profits | Where this is relied upon in an application evidence from the business accounts is required; again, 3 years is preferable. |

Please remember that 3 years evidence must be obtained unless they have been trading for less than three years, this, of course must be documented on file.

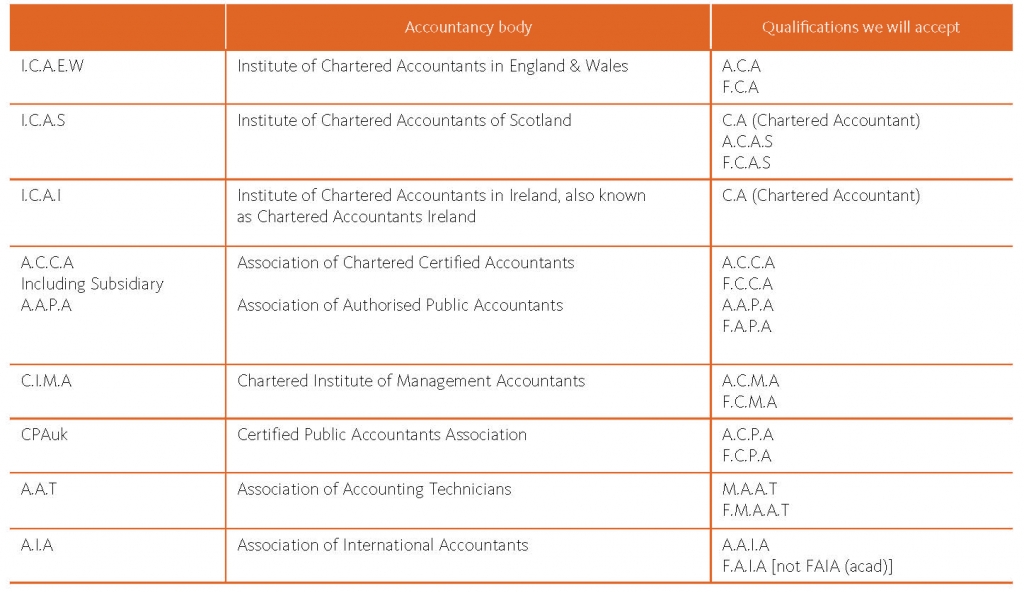

Reminder – Accounts must have been produced by a suitably qualified person and appropriately signed off. A list of suitable qualifications is detailed below:

An accountant’s certificate cannot be relied upon as proof of income as this is normally sent out by the lender direct to the accountant after an application has been submitted.

Buy to Let

Please also remember that at the Right Mortgage and Protection Network, we treat Buy to Let mortgages in the same way as all other mortgages – this will become all the more relevant with the move towards Consumer Buy To Let and the Mortgage Credit Directive. Therefore, proof of income is expected on all BTL files whether required by the lender or not.

Key Message – Attach Supporting Documentation

The client file is your protection against lender sanctions, financial crime investigations, complaints etc. It is vital this contains all the information and evidence taken during the sales process and is kept up to date.