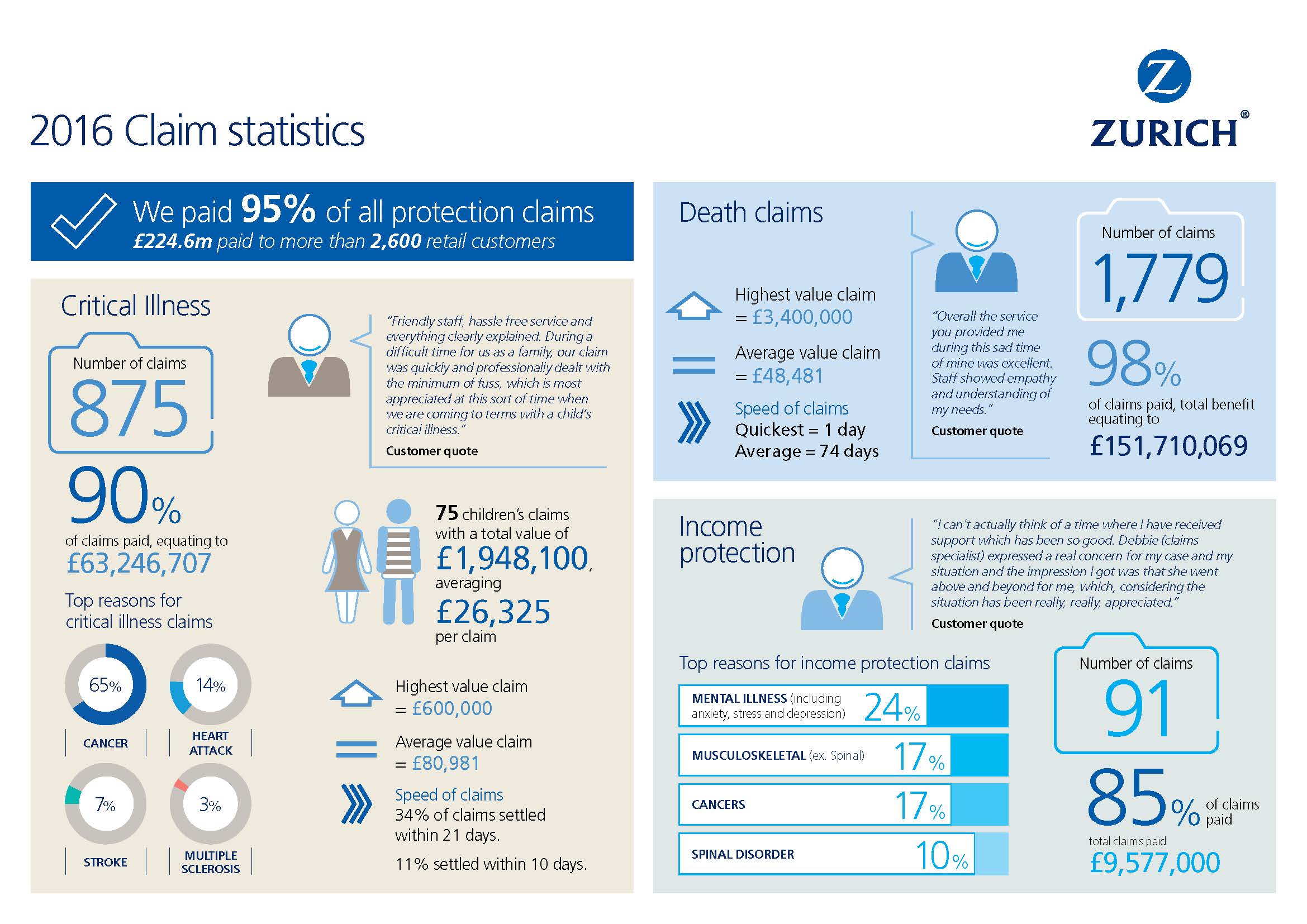

- £224.6m paid to more than 2,600 retail customers

- 95% of all protection claims paid

- £1.9m paid for children’s critical illness claims

- Nearly one in five (19%) critical illness claims for breast cancer, nearly a quarter (24%) of income protection claims for mental illness

Leading insurer Zurich today announced that it paid over £224.6m in protection claims last year to its retail customers, an increase of 6% from £212.5m in 2015. Over 95% of claims were paid out during the period, benefitting over 2,600 customers and their families with critical illness, income protection and life insurance policies.

Critical illness claims

Over 90% of critical illness claims were paid in 2016 to 789 customers amounting to £63.2m. The highest claim over the period was £600k with the average being £80.9k.

Cancer was the most common reason for claims accounting for over 55%, followed by heart attack for 14%, stroke 7% and multiple sclerosis 3%. Breast cancer alone, excluding other forms of the disease, triggered nearly 1 in 5 claims.

Over £1.9m was paid in critical illness claims for children helping 75 families at very difficult times with payments averaging £26.3k. The most common cause of claims for children was cancer.

Just 8% of claims were declined as the conditions claimed for were not covered by the policy definition while 2% were not paid for non-disclosure of medical information. An example of non-disclosure includes one customer who claimed for breast cancer though on applying had withheld a history of smoking and early diagnosis of the same condition in a parent.

Life claims

Most life claims were paid over the period with 98% accepted from 1,750 customers amounting to £151.7m.

Just 2% of claims were declined because of non-disclosure of medical information. For example, one case involved a customer who was diagnosed with acute renal failure shortly before application and did not disclose this when applying for the policy.

Income protection

For income protection, a total of £9.5m was paid out to around 532 customers unable to work because of illness or disability.

Nearly a quarter of income protection claims (24%) were for mental illness including anxiety, stress and depression. This was followed by both cancer and musculoskeletal disorders for 17% and back problems for 10%.

Nearly a quarter of income protection claims (24%) were for mental illness including anxiety, stress and depression. This was followed by both cancer and musculoskeletal disorders for 17% and back problems for 10%.

The causes of these claims highlight the importance of customers notifying insurers of illness as soon as possible to ensure they benefit from early support that may not be readily available through the NHS. This might include counselling or physiotherapy.

There were 91 new Income Protection policy claims last year and 77 (85%) were successful. Fourteen claims were not paid because the policy’s criteria were not met. This includes five for example where customers returned to work before the policy’s payment period started. In these cases, while no financial payment was made, customers will have had access to rehabilitation and treatment to help them recover and return to work.

Alan Lakey, Director at CIExpert commented: “It’s good to see Zurich quick off the block again with their results – it is vital that insurers are open and disclose their claims history. The only means of combatting distrust about providers paying on claims is to provide full details together with explanations when figures may appear to show a high percentage of declined claims. Not only does this help to educate potential clients, it assists advisers and insurers in persuading more consumers to buy essential products to protect their families, themselves and their businesses”.

Peter Hamilton, Director, Zurich UK said: “We’re proud to be able to announce an increase in the amount we’ve paid to our customers last year and that pay-out rates are consistently high. We hope this reassures customers that the vast majority of claims are paid.

“We would also urge customers to review their policy documents so that they are fully aware of their cover and its benefits. Child critical illness cover for example, is a free benefit to policy holders as is access to the Zurich Support Service offering a legal helpline, expert counselling and general advice on everything from obtaining probate right through to debt management.

“We also offer support to those with life policies by helping families with up-front financial support for funeral costs or administering the estate, where we can make payments without the need to wait for probate. We recognise that this will be a difficult time and so look to ease any financial worries as much as possible.”