Hope you’re enjoying the sunshine and the tennis!

Just wanted to make sure you knew about the changes we’ve made to the way we look at missed payments? We’ve had some really positive feedback so far, so I wanted to make sure you didn’t miss out. Here’s a real life case study to explain the changes:

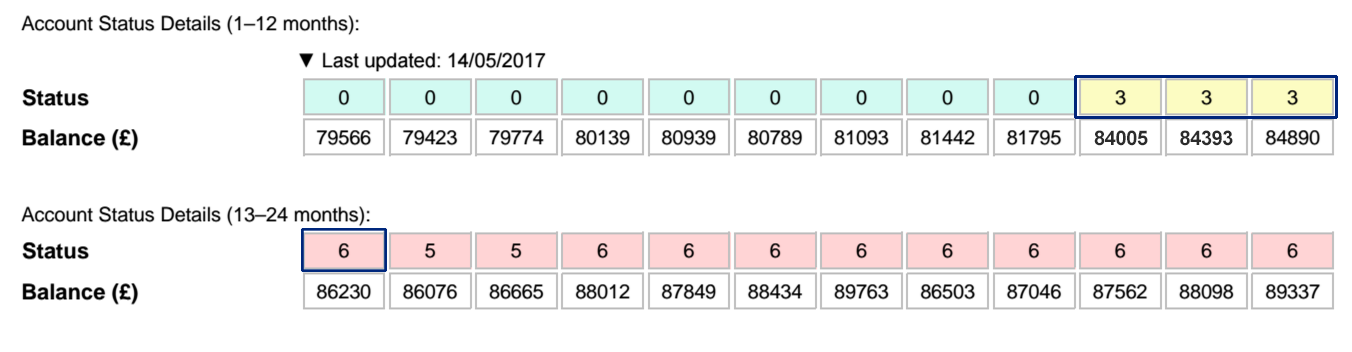

Mr F was made redundant 4 years ago and as a direct result was unable to make all his mortgage payments. Although he made small payments during this time and his account is now up to date, his credit report showed a Status 3 in the last 12 months and Status 6 within the last 13-24 months.

Previously we would have declined this application as we would have classed the status 3’s within the last 12 months as a missed payment and allowed for a maximum of status 4 in months 13-24.

As payments have been made continually in last 12 months and Mr F has only missed one additional payment in months 13-24 we’re happy to approve this application on our AAA Product range.

We’re getting some great feedback about our service at the moment too! The guys are working hard to turn things around well within published service levels. If you’ve got an enquiry or something similar sitting on your desk and you’d like to talk it through, give me a call.

Louise Garstang

Telephone BDM | Midlands & Wales

0203 743 1609