At the Labour Party Conference in October 1996, Tony Blair uttered the immortal words that became synonymous (The war on IRAQ aside) with the soon to be installed Blair government.

“Ask me my three main priorities for government, and I tell you: education, education, education”

I am a firm believer in this mantra – education is key, and it doesn’t end when you finish your time in the formal education system.

In a press release from the Financial Conduct Authority earlier this week they urged action on interest only mortgages – Yes, too many customers are sat on interest only mortgages without sufficient consideration having been given to repayment and the potential repercussions of not doing so.

It is stated that nearly one in five customers have an interest only mortgage, and despite the efforts of lenders to engage clients regarding the risks take up from consumers has been low.

Jonathan Davidson, Executive Director of Supervision – Retail & Authorisations, said:

“Since 2013, good progress has been made in reducing the number of people with interest-only mortgages. However, we are very concerned that a significant number of interest-only customers may not be able to repay the capital at the end of the mortgage and be at risk of losing their homes.”

“We know that many customers remain reluctant to contact their lender to discuss their interest-only mortgage for a variety of reasons. We are very clear that people should talk to their lender as early as possible as this will give them more options when it comes to the next steps they can take.”

“We are encouraged to see that lenders have taken positive steps to engage with and help their interest-only customers. However, as the number of maturities start to increase towards 2032, it is important that lenders take time to review and, where possible, improve, their own strategies.”

It is clear that, for a ‘variety of reasons’ consumers are failing to engage with their lenders early enough and this is restricting their options for the future.

It is suggested by the regulator (based on the 2017 MLAR – Mortgage Lenders and Administrators Return) that there are 1.67 million interest only, or part and part, mortgage accounts in the UK. Additionally the FCA has stated that there are three maturity peaks predicted over the coming years:

- Now – It is anticipated that those interest only mortgages currently maturing will have modest shortfalls due to the profile of customers typically being those who are approaching retirement with higher incomes, assets and levels of forecast equity in their property at the end of term.

- 2027/2028 & 2032 – It is anticipated that these two maturity tranches will include less affluent individuals who had higher income multiples at the point of application, greater rates of mortgages converted from repayment to interest-only and lower forecast equity levels; the FCA is concerned that they are more at risk of shortfalls

Interestingly, in its press release, the FCA seems to focus on the role of the lender to improve engagement strategies and continue their positive steps to deal with, what some industry commentators have referred to as a ‘ticking timebomb’. I prefer to think of this as a great opportunity; an opportunity for sharing information and providing education.

So what are we going to do?

I don’t know about you, but I feel a great responsibility to these ‘one in five’ mortgage borrowers. After all, these borrowers could include my friends and family and I certainly wouldn’t want to see them lose their homes after years of hard work!

That’s where Tony Blair comes in – We, in our industry are in the privileged position of having some solutions to what, for some, is a complex problem. Yes, education is the key.

Lenders will be looking for solutions, but they are generally restricted by their own product range, shareholders, access to funds, board of directors and the PRA. We on the other hand have access to multiple products, specialist products and some very ingenious solutions.

One such solution that I would like to remind you of can also be summed up in three words:

Later Life Lending

You will recall that last year (February if memory serves me correctly) we ran a very popular event that really pushed the importance of advisers engaging with clients and looking at later life lending solutions – the feedback from this event was excellent; but one year on, how have you done? Have you engaged with your client bank? Have you begun sharing knowledge and educating your client bank? Have you got a clear strategy in place? Have you sat your equity release exam?

If not, don’t be dismayed; 2018 is a new year and we will be pushing even harder this year to help advisers progress in this area. We have reviewed the training we provide and are convinced that with some adjustments and additional support from us, 2018 will see a significant increase in the number of advisers engaging in later life lending.

At The Right Mortgage we are committed to helping clients better understand what solutions are available to their borrowing needs and we see these interest only maturities as an opportunity to prove the value of an adviser.

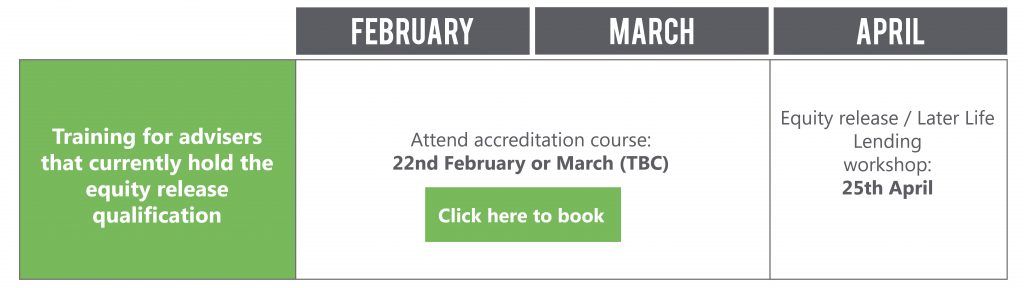

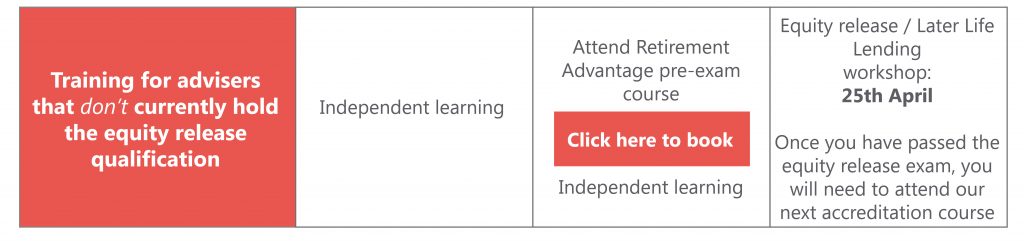

As a network, we will give full support and training to advisers that want to enter this market so you can advise with confidence. Below is a table of the training and development work we are doing over the coming weeks to assist you to progress into the later life lending space and towards educating your clients.

To find out more, register your interest in selling equity release or to book a place on our next equity release accreditation course, please email maxine.levers-riley@therightmortgage.co.uk

The first bit of support we are providing is this brochure from the regulator which you can use to start the discussion regarding interest only shortfalls.

So there you have it… Education is the key and we are the ones to provide it.

For those of you interested in all things regulatory – keep your eyes peeled for the Mortgage Market Study from the FCA; the interim report is due in the spring and the Final report is anticipated at the end of 2018.