Protection Guru – Everything you need to know about Guaranteed Insurability Options

Hi everyone, welcome to this weeks protection update.

Now this week is all about the NTE and I’m recording this on Tuesday which is why I can’t comment on how things went, but I’m sure it was a good one…

Now I’ve gotten into a habit of sending something out, protection related each and every week so I just wanted to give a single focus this week to a piece of work carried out by Protection Guru.

The work the team over there are doing is truly remarkable and if you’re a protection adviser; this is a resource you should be using and I’m going to give you a flavor of this particular piece called “EVERYTHING YOU NEED TO KNOW ABOUT GUARANTEED INSURABILITY OPTIONS by Rob Harvey.

Let me read you the opening text and then we’ll look at a few examples…

Guaranteed insurability options allow clients to increase their protection cover, following certain life events, without further underwriting.

Protection Guru say that whilst being far from perfect; the GIO feature provides a valuable means of ensuring the policy can adapt to a change in the client’s circumstances and the need for increased cover.

Over the last few weeks, we’ve covered GIOs across the full range of protection products and today bring those insights together in a single ‘everything you need to know’ roundup.

I’ll add the links to this weeks protection update.

Protection guru also say that as an additional point, they want to take the opportunity to highlight that we still believe there is work to do in improving the flexibility of products to adapt to a client’s changing circumstances. GIOs provide a useful means of increasing cover without further underwriting, but this is still mostly limited to a fairly small list of traditional life events and with a time constraint.

As many consumers no longer follow a traditional path through life, it’s essential the products we offer properly reflect the changing needs and lifestyles of the people that need protecting.

Income Protection Guaranteed Insurability Options

Click here to read Protection Guru’s article “Income Protection Without Underwriting”

If we start by looking across the market at Income Protection related GIO’s, Protection Guru have added a very easy to follow graphic to show who does what

Aviva, Royal London and The Exeter include the most extensive range of life events on which GIOs can be exercised. As you can see, there isn’t a life event that these life offices don’t let you exercise a guaranteed insurability option. Remember that means more cover with no medical underwriting.

The rarest GIO here is when people get divorced or have a civil partnership dissolved. These 3 life offices plus Zurich are the only providers that offer a GIO.

Reading a bit further down the page, you can see that Legal and General, Vitality and Cirencester offer policy anniversary-based increase options on either the 3rd or 5th year anniversary.

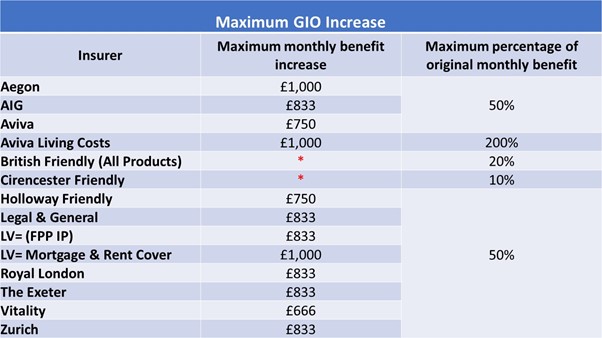

And they have included a table which shows all the monetary amounts to show how much the policy can be increased up to.

There is a bit more in the IP research piece so please click on the link and take a look.

Life and Critical Illness Cover Guaranteed Insurability Options

Click here to read Protection Guru’s article “Income Protection Without Underwriting”

Again to make things easy for you to follow Protection Guru have listed a table which shows you exactly who does what in terms of all the possible Guaranteed Insurability Options for Life and Critical Illness policies.

Aviva, Royal London and The Exeter include the most extensive range of life events on which GIOs can be exercised. As you can see, there isn’t a life event that these life offices don’t let you exercise a guaranteed insurability option. Remember that means more cover with no medical underwriting.

The rarest GIO here is when people get divorced or have a civil partnership dissolved. These 3 life offices plus Zurich are the only providers that offer a GIO.

Reading a bit further down the page, you can see that Legal and General, Vitality and Cirencester offer policy anniversary-based increase options on either the 3rd or 5th year anniversary.

And they have included a table which shows all the monetary amounts to show how much the policy can be increased up to.

There is a bit more in the IP research piece so please click on the link and take a look.

Life and Critical Illness Cover Guaranteed Insurability Options

Again, to make things easy for you to follow, Protection Guru have listed a table which shows you exactly who does what in terms of all the possible Guaranteed Insurability Options for Life and Critical Illness policies.

Protection Guru report that Legal & General are unique in the market in offering a complete separate rental life insurance product.

It’s worth pointing out that Guardian are the only life office who offer a unique GIO which is available when a policyholder loses cover due to a change in their employer.

Guardian, HSBC Life (new to our Protection Panel) and Scottish Widows are the only life offices who have a GIO specifically when the policyholder becomes a legal guardian of a child.

Remember, you could be in a situation where you are completely uninsurable, but you can still increase your cover with no medical underwriting.

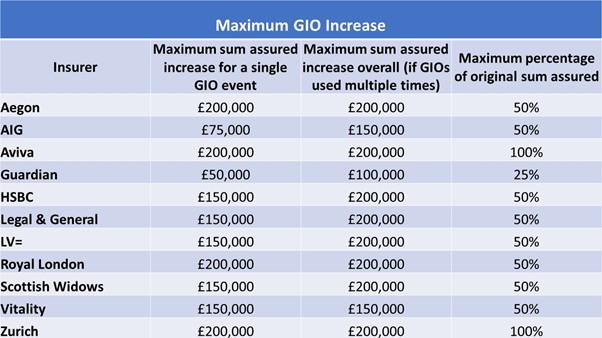

There’s another table which shows maximum sums assureds by which the policy can be increased by for a single GIO event and then the maximum total.

There are differences between the providers and looking at the table it’s only Aviva and Zurich that will allow you to increase your cover by 100% of the original sum assured.

And one more table…

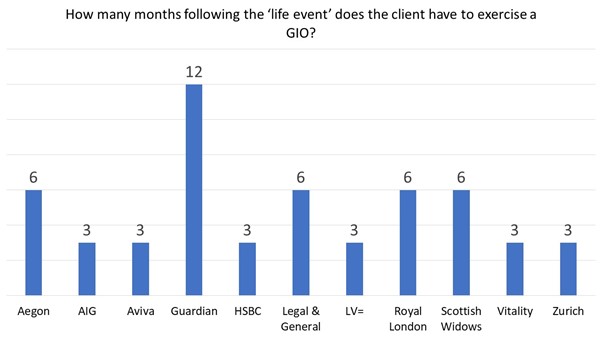

How many months following the life event does the client have to exercise a GIO.

Typically, this is 3 months for most life offices.

Some including Aegon, L&G, Royal London and Scottish Widows will give you 6 months.

But Guardian will actually give you 12 months. So, they have the most amount of GIO’s on their policy and give you the longest amount of time to use them.

Now all I’ve done this week is just illustrate some of the amazing content available from Protection Guru.

It’s free to sign up and it’s free to use – such a valuable resource.

There is another whole section related to business protection GIO’s in this article, but I’ll leave that to you to take a look.

So, I hope you had a good time at the NTE.

That’s is from me for another week; have a great weekend and I’ll see you soon.