Unlike typical critical illness cover, our Serious Illness Cover pays your client on a severity based approach. This means that our cover provides a payout proportionate to the severity of a condition.

With advances in medical technology and screening processes, we recognise that conditions are being caught sooner. These early stage illnesses may not be eligible for a payment with another provider, but we know that they can still cause stress and often lead to time being taken off work.

If your client needs to claim for a condition that does not use up their full cover amount, they will still have cover available. So if their condition worsens, or they suffer with a different condition, they’ll be able to can claim again and again, until they’ve used up the full amount.

To cater for different needs and budgets, we have two levels of cover for your clients to choose from:

Comprehensive cover gives your clients cover for 178 conditions. With Comprehensive Cover, conditions are covered from Severity A (100% payout) to Severity G (5% payout). Cancer Relapse Benefit is now included as standard.

Primary cover covers your clients for 145 conditions and is a more affordable option. With Primary Cover, conditions are covered from Severity A (100% payout) to Severity E (15% payout).

How does severity work?

We’re able to cover a broader range of conditions than our competitors because we use severity based payments that reflect the impact an illness has on your client’s lifestyle.

Where to next?

See how our cover really does make a difference to people’s lives.

Visit our adviser website for more information and to find out all about Serious Illness Cover.

Use our interactive tool to find out which conditions are covered by our Serious Illness Cover.

We have a wide range of Serious Illness Cover literature available for you.

Our adviser training video provides an overview of Serious Illness Cover.

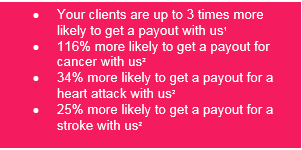

1 Hannover Re UK Life Branch – February 2017

- Estimates are based on Hannover Re UK Life Branch’s interpretation of the general population incidence rates and their estimated view of future trends. Incidence rates for the entire population may be different to those lives that take out life insurance products.

- The typical critical illness product is a mid-market one and covers most conditions seen in the market

- Vitality Life estimates are based on the Vitality Life Plan with Comprehensive SIC

These estimates are for information only and are based on Hannover Re UK Life Branch’s analysis of statistical data. Hannover Re UK Life Branch accepts no liability for any reliance placed upon these estimates and any use of the analysis is the sole responsibility of the user.

2 Hannover Re UK Life Branch February 2017, comparison versus ABI Statement of Best Practice 2014.