Following a review of our lending criteria we have made amendments to our income multiples policy for residential lending.

Applications will now require an income of £55,000 or more (sole or joint) to qualify for a 5.00x income multiple. This replaces the previous £45,000 income threshold.

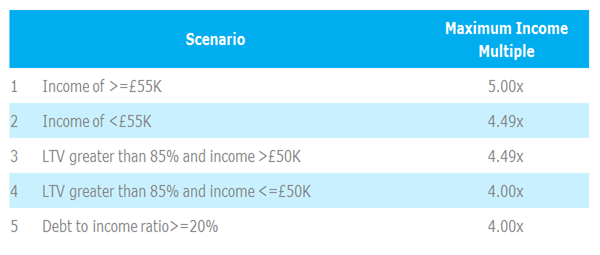

The table below provides an overview of the full income multiples criteria:

Please note the following multiples apply for specialist schemes:

1) Family Springboard – a maximum multiple of 5.5x applies for incomes above £50,000.

2) Premier and Wealth customers – up to a maximum multiple of 5.5x applies for repayment loans. This is subject to current Premier lending policy guidelines.

3) Help to Buy Schemes – a maximum multiple of 4.49x applies

What does this mean for you?

All cases started from today (Thursday 31st August) will be subject to the new criteria as above.

All applications started on or before Wednesday 30th August will continue to be assessed under the previous income multiple policy rules, including any pre-contract/post contract variations.

Adding of fees

The policy in respect of the adding of fees remains unchanged. Please note that where a fee is added to the loan amount this will be included in the income multiple calculations.

To prevent the adding of a fee from resulting in a decline (and subsequent remodelling of the borrowing amount) please ensure that, where appropriate, the addition of fees to the loan is selected in MAX prior to DIP.

Need further support

Further information on our policies is available from the lending criteria section of the website.

Our residential affordability calculator has been updated to reflect the new income multiples policy.

Please refer to your Intermediary Relationship Manager for any further information.