Please be advised we are making changes across our Residential, Buy to Let and Reward ranges effective from Tuesday 2nd June, 2020.

Key Changes

Following the introduction of desktop valuations, coupled with the return of physical ones, we are pleased to confirm the following product changes to support the purchase market:

- Introducing new 60% and 75% 2 year trackers, including large loan options available for loans up to £5m

- Reducing rates by up to 0.10% on a selection of Help to Buy products

- Introducing a new 75% LTV 2 Year Offset Tracker for Residential purchases and a competitive 75% LTV 2 Year Fixed Buy to Let purchase only product

New Residential Purchase Product Highlights:

- Reduced 1.34% 2 Year Fixed, £999 fee, 75% LTV, Loans £5k – £5m – reducing to 1.25%

- Reduced 1.49% 5 Year Fixed, £999 fee, 60% LTV, Loans £5k – £5m – reducing to 1.45%

- New 1.18% 2 Year Tracker, £999 fee, 60% LTV, Loans £2m – £5m

Please be advised there are other changes to products within our ranges, including withdrawals and rate increases. Please view our rate overview document.for full details.

Please view our new Intermediary and Reward range rate sheets and see below for key timelines for when products are being launched and withdrawn.

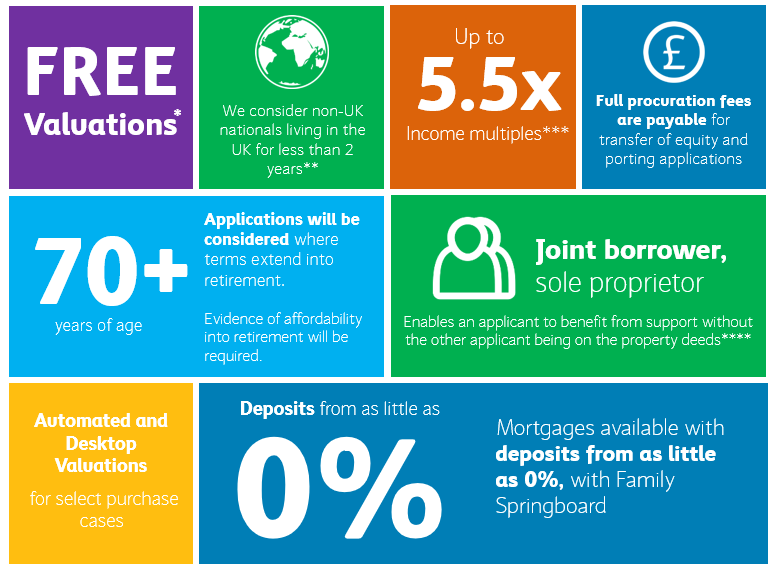

Why choose Barclays for purchase?

Key timings*

- Existing products: Final date for generating a Mortgage Information Sheet (MIS *: Monday 1st June, 2020

- New products available: Tuesday 2nd June, 2020

- Last Rate Switch applications (Product Transfers): Tuesday 2nd June, 2020

Last Further Advance applications: Wednesday 10th June, 2020

*Applications on an existing product

To qualify for a product, a MIS needs to have been generated, on or before the date of withdrawal (Monday 1st June), either using our Barclays systems or your preferred sourcing tool. The application is also required to have been successfully submitted prior to the last application date – Tuesday 2nd June for product transfers and Wednesday 10th June for all other products.

Please be advised that upon withdrawal, the products will be removed from the dropdown options within our new lending application services. Therefore, you will need to ensure the product has been selected and saved in the application today