Duty of Care

Ben Allen, Compliance Director

I can remember it like it was yesterday…

The day my Wife and I brought our new baby daughter home for the very first time. That journey from Bristol to Nailsworth (a journey that I had done many times quite competently) suddenly filled me with fear. In the words of Dustin Hoffman “I am an excellent driver” [sic] but what about everyone else? Would we make it back safely with this precious package that had been entrusted into our care? Or, would I fail at the first hurdle as a Dad?

I carefully strapped Lola into her brand new car seat and set off on a journey that filled me with trepidation.

Eight years later and I’m still on that journey, but I am, perhaps, a little more competent and a little less nervous.

My point is, that at some point in life most of us end up in a situation where we will have to take care of another. For most that would include caring for parents, a spouse or our children. But for those who are regulated by the Financial Conduct Authority, we have an additional duty of care…to our clients.

The change by the regulator to the Senior Managers Regime has recently introduced a duty of responsibility, which came into force last May; currently it applies to those who hold senior management functions in UK banks, building societies and credit unions as well as Prudential Regulation Authority (PRA)-designated investment firms; but you can rest assured that it will be extended to the wider industry in the coming years.

The concept of a duty of care over our clients is not a new one; no, the regulator in its previous guise as the FSA introduced their policy on Treating Customers Fairly many years ago, and ‘Fair Treatment of Customers’ continues to be its maxim in its reincarnated guise as the Financial Conduct Authority.

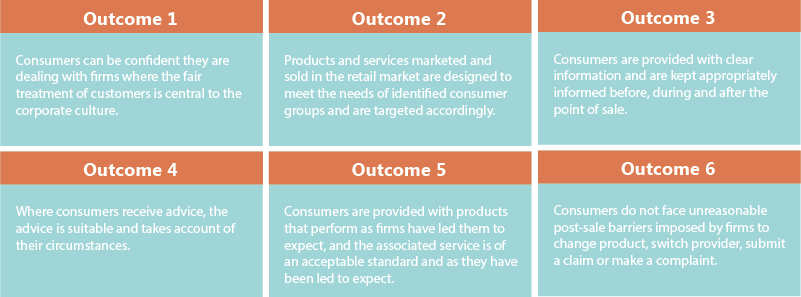

Let’s remind ourselves of the six consumer outcomes (associated with Treating Customers Fairly).

In addition to the principals above, the FCA also has Principals for business, number six of which, states:

‘A firm must pay due regard to the interests of its customers and treat them fairly’, but other principles also apply to this area of business behaviour.’

In their mission statement of October 2016 the FCA refer to the Financial Services Consumer Panel (an independent statutory body, set up to represent the interests of consumers in the development of policy for the regulation of financial services. They work to advise and challenge the FCA from the earliest stages of its policy development to ensure they take into account the consumer interest).

In the view of the Financial Services Consumer Panel, ‘consumers can only reasonably be expected to take responsibility for their decisions where firms have exercised a duty of care.’

Historically the regulator has argued against the need to instigate a ‘Duty of Care’ based upon the Principal based regulation and TCF regime under which we work. However, they are clearly being pushed in this direction to allow for consumers to bring civil claims in line with a ‘Duty of Care’.

The Financial Conduct Authority’s big question is: ‘Would a Duty of Care help ensure that financial markets function well?’ Which, as we all know, is part of their remit.

Of course, we don’t need to have a prescribed duty of care to allow individuals to claim, where in the eyes of the consumer, there has been some element of negligence on the part of a financial institution or adviser. We could state the examples of Endowment, PPI, Credit Agreement and Packaged Bank Account claims as a few examples of a ‘claims culture’ which has impacted directly on our business.

In a recent survey of our membership, 98% of respondents stated that they felt we do have a ‘Duty of Care towards our clients, particularly when it comes to advising them to ‘protect their mortgage’. In addition 64% felt that if services such as Mortgage Protection, Buildings and Contents Insurance, Income Protection, Lasting Powers of Attorney and the importance of placing Policies in Trust, were not suitably discussed with consumers this could result in a negative outcome for the consumer. It was also felt that this could result in both complaints and loss of business.

It is my belief, based upon the survey conducted, that regardless of regulation and a prevalent claims culture, we do indeed have a ‘duty of care’ to our customers and that we are obligated to ensure that they receive good quality advice according to their circumstances.

So why is it then that so many advisers ignore protection needs, avoid making use of wills & trusts or fail to write buildings & contents insurance?

The answer evades me – I really cannot see why anyone would take a lower income and put their business at risk. But even if those purely altruistic sentiments were not the reason we got involved in the wonderful world of financial services, I’m convinced that the improved income received from demonstrating a duty of care would be a strong enough reason to get even the most cynical and jaded adviser to give this ‘duty of care thing’ a go.

At The Right Mortgage we are keen to ensure that your customers continue to get the highest level of service and that they are suitably cared for. That is why we have introduced training courses for, protection advice, equity release, lasting powers of attorney, wills, trusts, buildings and contents insurance and complex borrowing solutions. We have also introduced a referral process which equates to a 50/50 split of commission between the referrer and the adviser.

Consider this: Imagine clients have approached you to conduct their mortgage; they are first time buyers with two children. Dutifully you complete a fact find and ascertain that they have no will, no power of attorney and no forms of protection in place. What will you discuss with them?

Some would charge a 1% fee, write the mortgage and be satisfied that the procuration received would cover their costs.

But would you consider (Based upon a £150k mortgage) all of these?

Product | Remuneration |

| Advice Fee | £499 |

| Mortgage Procuration Fee | £525 |

| Mortgage Life Cover | £1375 |

| Family Income Benefit | £634 |

| Income Protection | £1270 |

| Buildings and Contents Cover | £108 |

| Lasting Powers of Attorney | £400 |

| Will | £100 |

| Total | £4911 |

Of course, there are many variables that could affect the costs above, but they give an indication of both the needs that clients have, what products & services you should be discussing and the income that you can derive from demonstrating a ‘Duty of Care’ to your clients.

In addition there are other areas that could be considered such as writing policies in trust.

So there we have it, on one hand you could demonstrate a duty of care and massively increase your profitability or on the other you could find yourself having to defend your position for not acting in line with the FCA principals and failing to demonstrate a duty of care.

As a network, we will shortly be issuing guidance regarding certain aspects of your ‘Duty of Care’ and this will form the central theme of our National Training Event on 10th May 2017.

THE RIGHT MORTGAGE AND PROTECTION NETWORK – A NETWORK OF OPPORTUNITIES!