“In America, anyone can become president. That’s the problem.”

– George Carlin, Comedian

Before anyone concludes that I’m in some way trying to make a political point, please let me reassure you that I am not.

Do you know the qualifications required to be President of the United States?

There are three:

- A natural born citizen (U.S. citizen from birth);

- At least 35 years old and;

- A U.S. resident (permanently lives in the U.S.) for at least 14 years.

Of course, different states have their own selection criteria for candidates, but broadly speaking, the qualification criteria to be President, is certainly rather brief. Interestingly, the same can be said of those looking to take up a role in ‘Protection Advice’.

For many years, individuals have been able to join the UK Financial Services arena, one of the most regulated business sectors in the world, and start giving advice to consumers with no experience and no qualifications (not at The Right Mortgage I might add). Of course, the regulator has ICOBS and other parts of their handbook to try and bring some sort of oversight to proceedings, but ultimately, join the right firm (or the wrong one, depending on how you look at it) and you could be on the phone selling insurance within a couple of hours of reading the job advert.

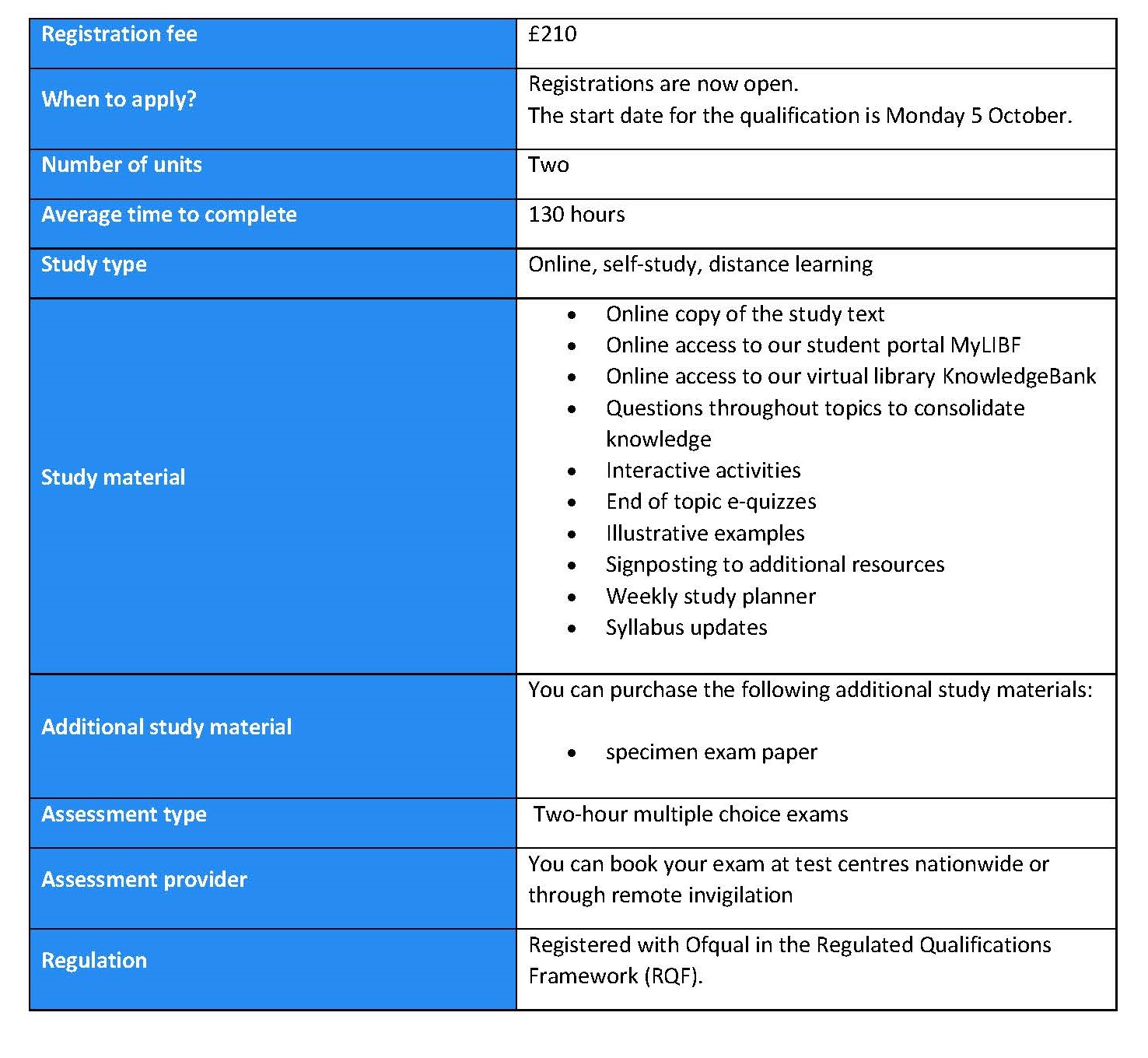

This week, however, has seen the introduction of a new qualification by the London Institute of Banking and Finance, the same people who brought you CeMAP (under their previous guise of The Institute of Financial Services).

The new qualification, CertPro, is aimed at individuals who are looking to enter the consumer (insurance) protection arena.

CertPro is designed to help advisers assist customers to ensure they get the right protection for their needs and circumstances, when they need it most.

It aims to help the student learn about the protection sector and the relevant rules and regulations. It promises to help the ‘learner’ develop specialist knowledge to understand customer needs, and be able to advise on the different types of protection products, including Life, Critical Illness and Income Protection.

For many in the Network, our knowledge will no doubt be “fine, thanks,” after all, we have completed modules included within the CeMAP, FPC or CeFA qualifications we have achieved, which cover protection and advice. But, not all have traveled this road to qualification; therefore the introduction of a (voluntary) bespoke course, seems like a good idea for those who have chosen to specialise in protection. It will reinforce your knowledge, and add to your credibility, thus helping to differentiate a qualified adviser, from an unqualified one. Surely, that can only be seen as a positive.

I’m also pleased that this is a voluntary qualification, as it will help firm principals more easily identify the calibre of the individual they are interviewing for a prospective role within their business.

Anyway, please don’t read this as me saying all protection advisers without a qualification must sign up for the CertPro study material tomorrow. Or that unqualified advisers are in some way second-rate. Far from it, this is a voluntary qualification and should be treated as such.

It is acknowledged that qualification is only one piece of the jigsaw and there still needs to be a balance between, qualification, experience and ability.

That said, if you are looking to have that little edge over your competition, why not consider it, it is a great selling point for you and your business, and it demonstrates your commitment to consumers and the industry in which you work.