The demand for income protection insurance has been silently growing in the background for the past few years. Year on year, more customers are choosing to buy income insurance. There are a few simple facts that are giving rise to the increase in demand for income protection and they are as follows:

- Ongoing cost cuts of Government and the austere corporate approach is beginning to hit hard and impacting nearly every sector in the UK and business in the UK. Employers are trying to prune costs to meet their budget challenges and inevitably wage bills are often the first ones to be focused on.

- The uncertainty of Britain’s position in the EU is impacting several multinational businesses, the manufacturing sector and most export businesses. Latest research by the Financial Times has shown that less than 25% of the CEOs believe that Britain will be better off outside the EU. Most businesses have either delayed their investments or looking at other places outside the UK.

- A combination of low savings amongst most UK household and rising job dissatisfaction means more people are looking for ways and means to protect their income from loss of employment, accident or sickness. The latest survey of Standard Life shows that 54% of working population wishing that they could change career.

The Right Mortgage Network’s Income Protection Portal powered by Best Insurance has some of the best products available in the market to meet this rising demand.

Research has shown that 1 in 3 working adults have a financial resolution at the beginning of the New Year and most of it around securing their income.

With the rising uncertainty in the job market, more and more people becoming self-employed and the threat of yet another looming slow growth period, it is good timing to talk to your customers and make them aware of such policies.

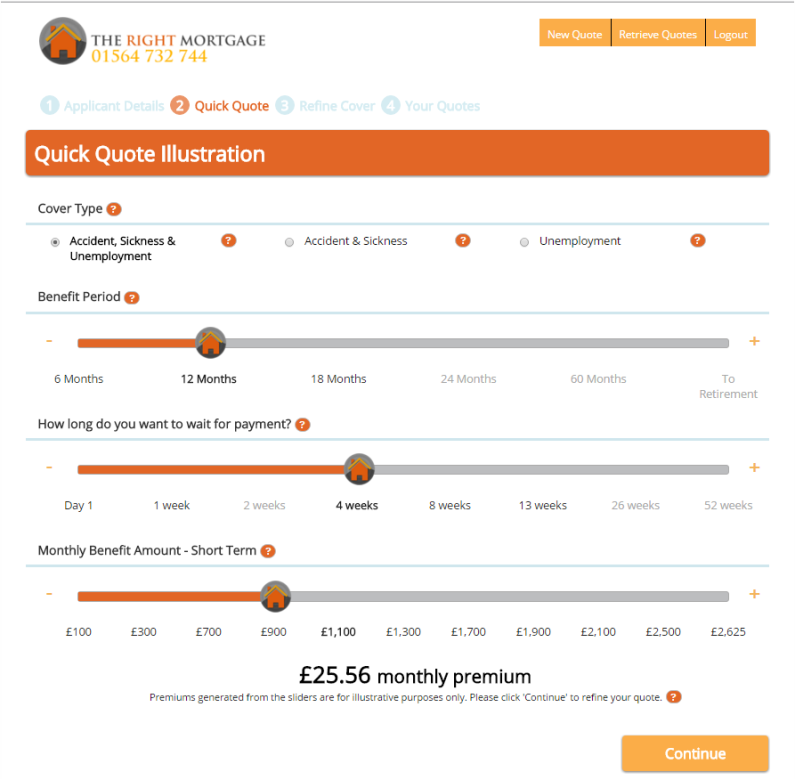

Contrary to the common perception that these policies may be expensive, on average all your customer needs to set aside is less than £1 a day. This will allow them to get tax free £1,000 a month for 12 months if they lose their job or have a loss in income due to accident or sickness.

The “Simple Income Insurance” recently launched by Best Insurance is a very competitive product and many advisors have had good success in terms of sales conversions.

Best Insurance also provides free web based training on all aspects of income protection insurance, sales aids and a help desk support.

Unlike mortgages, selling income protection insurance brings in recurring income month upon month and hence the efforts that you put in gets rewarded continuously for a long period of time.

If you need access, or any information on the The Right Mortgage Income Protection Portal, contact Best Insurance on 0330 330 9465 or email ask@bestinsurance.co.uk

Kesh Thukaram,

Director – Best Insurance