We’ve made changes to the way we view missed payments and now only consider the number of missed payments rather than the worst status.

Here’s a real life case study to illustrate how this will help you help more customers.

Our customer story:

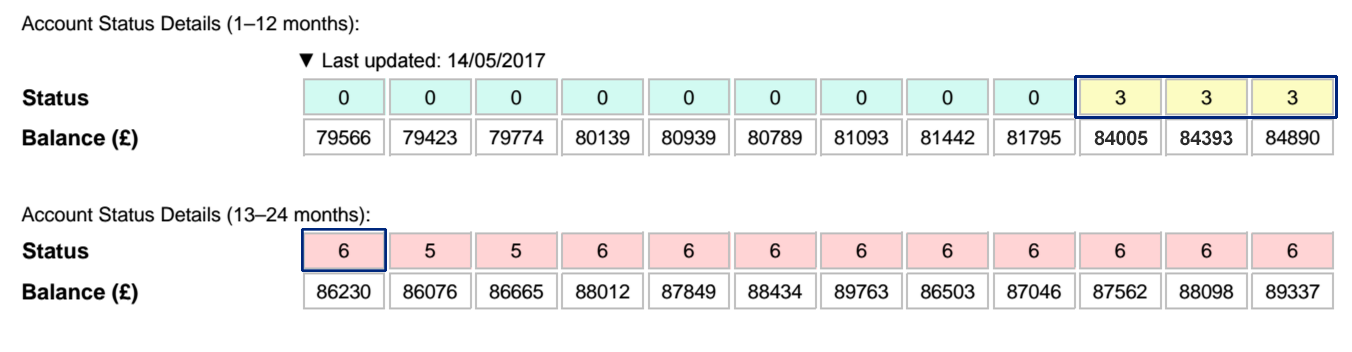

Mr F was made redundant 4 years ago and as a direct result was unable to make all his mortgage payments. Although he made small payments during this time and his account is now up to date, his credit report showed a Status 3 in the last 12 months and Status 6 within the last 13-24 months.