A third of mortgage holders who used an adviser will go elsewhere when their fixed deal ends – but untapped opportunities exist for brokers to retain clients

- One in three (32%) homeowners aren’t planning to go back to their current adviser when their fixed deal ends

- Advisers benefit from opportunities to stay in touch as two in five (42%) homeowners haven’t heard from their broker since taking out their mortgage

- Half (49%) of homeowners have had a change in circumstances since taking out their mortgage but 39% of those haven’t updated their policies

Independent mortgage advisers face the risk of their clients drifting away, as a third (32%) of homeowners who organised a fixed deal through a broker are likely to go elsewhere when the term nears its end, new research from Canada Life1 reveals.

Of those who intend to take a different route when their fixed rate mortgage ends, 15% will take out a new product directly with a bank or lender, 10% will review with a different mortgage adviser and 6% will take out a mortgage via a comparison website.

Two in five homeowners did not update their protection policies after a change in circumstances

With two in five (42%) homeowners saying their broker hasn’t contacted them to review their mortgage since taking it out, including 49% of people who have had a mortgage for over 10 years, advisers would benefit from opportunities to stay in touch with their clients.

One such opportunity lies within protection policies, often sold alongside mortgage products. Half (49%) of homeowners surveyed have had a change in personal circumstances since taking out their loan, but 39% of those did not update their protection policies. The nation is chronically under-protected, with the ABI estimating a protection gap in the UK of £2.6 trillion in 2012.

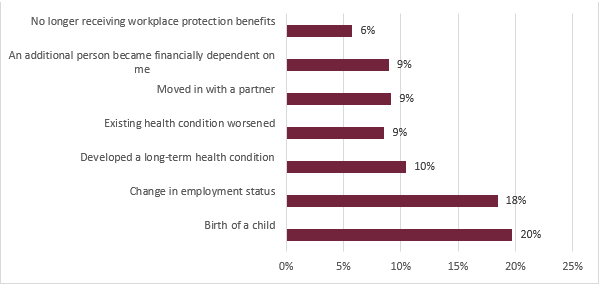

Common changes in personal circumstances include having a child (20%), a change in employment status (18%), developing a long-term health condition (10%) or an existing health condition worsening (9%) – all of which can impact the type and level of cover required.

Graph One: Changes in personal circumstances since taking out a mortgage

With 61% of homeowners saying they have had no contact from their broker to review their protection needs since their initial meeting, and cover quickly becoming out of date as life progresses, advisers have an untapped opportunity to maintain contact and provide additional benefits to clients beyond advising on their mortgage.

Natalie Summerson, Head of Sales, individual protection at Canada Life comments:

“Our research has highlighted the importance of mortgage advisers remaining in regular contact with their clients particularly as many customers will not necessarily feel the need to revisit their mortgage deal for a number of years after the initial meeting.

“With longer fixed term mortgage deals on the increase and nearly 50% of customers confirming their personal circumstances have changed since they took out their mortgage there should be plenty of opportunity for advisers to re-engage.

“At Canada Life we aim to give advisers the information and tools they require to start proactive, positive conversations with clients about their protection needs.”

–

Notes to editors:

1 Based on research among 1,003 UK adults with a mortgage who took out their product with an independent adviser. Conducted in October 2019.

For further information please contact:

Lewis Hill

Instinctif Partners

Tel: 020 7457 2020

canadalifegroup@instinctif.com

–

About Canada Life:

We have been providing group products for intermediaries and their corporate clients for 45 years. We are one of the UK’s largest providers of group risk insurance, covering over 2.75 million people through our group insurance schemes.

In August 2015 we re-entered the UK Individual Protection Market with our Life Insurance and Life Insurance plus Critical Illness products.

For more information on Group Insurance, visit http://www.canadalife.co.uk/group/Default.asp

For more information on Individual Protection, visit http://www.canadalife.co.uk/individual-protection

Individual Protection Support Services provided:

- Personal Assistance Programme

- Personal Nurse Service

- Second Medical Opinion

- Bereavement Counselling

- Probate Helpline

- Treatment Sourcing

- The Canada Life app