“VitalityLife’s new, simple yet comprehensive Mortgage Plan means your clients have one less thing to worry about when they buy their new home,”says Andy Philo, Director of IFA Distribution at Vitality.

“Fewer choices, comprehensive cover and intelligent Optimiser Underwriting means your clients and their family can be fully covered in minutes. With the added benefits of the Vitality Programme, as well as substantial upfront premium discounts, your clients will be able to focus their time and money on what’s really important – turning their new house into a home.”

Buying a house is a major life event, with surveys finding it to be the second most stressful life experience (second only to losing your job). There are a number of things to worry about: finding the perfect home, negotiating with the seller, arranging the mortgage and the rest. It is no wonder that personal insurance is the last thing that many people want to think about at this time.

“That is why VitalityLife has launched our new Mortgage Plan – the simplest and most comprehensive protection solution specifically designed for the mortgage market. It eliminates the choice and uncertainty in choosing protection alongside a mortgage, and serves as a one-stop-shop to protect homeowners and their families.”

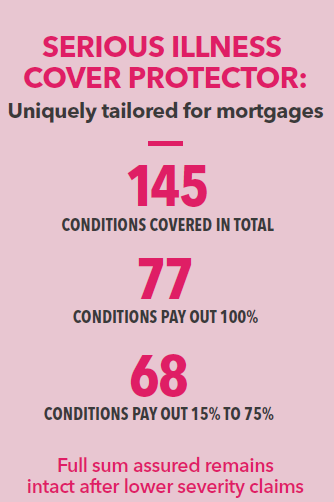

The product includes competitive Life Cover and comes with the option of adding the new, Serious Illness Cover Protector (SIC Protector) designed specifically for mortgages. SIC Protector Covers 77 serious illnesses at 100%, and 145 serious illnesses covered in total through severity-based payments.

With SIC Protector, lower severity claim payments do not reduce the sum assured, meaning that following a lower severity payment the full sum assured is still available to pay off the mortgage in the case of a Life or 100% Serious Illness Cover claim.

“As well as granting peace of mind, Mortgage Plan clients will benefit from all of the benefits of Vitality Optimiser, clients will get upfront premium discounts and access to a fantastic range of partners and rewards through the Vitality programme,” says Philo.

The product will also benefit from VitalityLife’s new, intelligent Optimiser Underwriting with just five questions for Life and Serious Illness Cover applications – a market-first for SIC. For unrated lives, the medical underwriting process could take as little as five minutes to complete. “Perfect when you’ve already been through reams of paperwork in your mortgage application,” says Philo.