As we head very quickly to the end of 2021, we’d like to take the opportunity to revisit some of our niche cases we’ve shared with you during the course of the year.

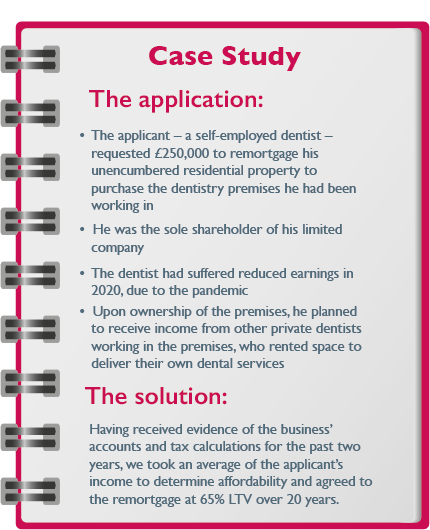

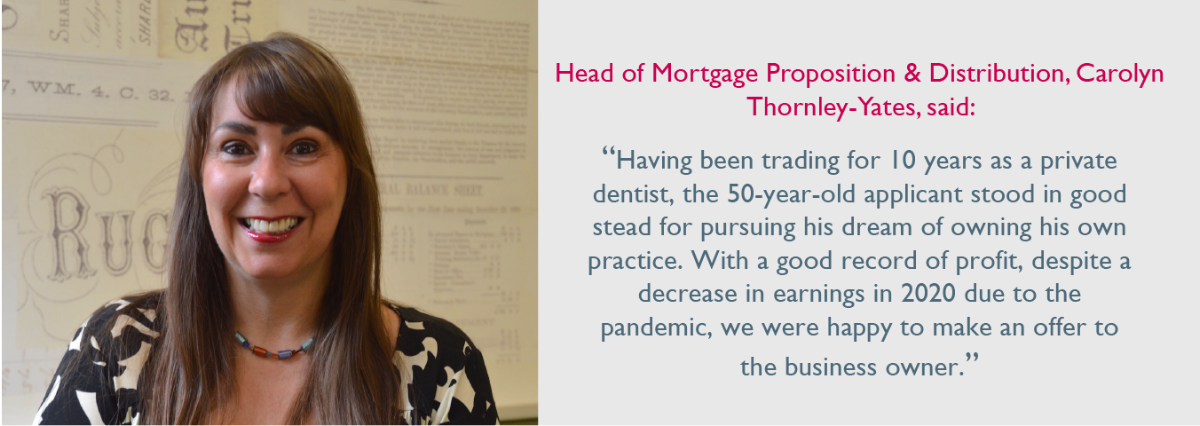

This week, we’re taking another look at a case study featuring a self-employed applicant.

If you have an unusual or complex case that you would like to discuss, please call us.

01455 894084

Alternatively, email our Business Development Team or use our website live chat

In case you missed it

We have increased the Loan to Value (LTV) offered to self-employed applicants, who can now benefit from up to 95% LTV mortgages.

Our Loan to Income (LTI) multiples for all borrowers, including self-employed, have also been enhanced to x4.49 above 80% LTV*. Additionally, we have increased our maximum loan size limits throughout our core Residential product range and across each LTV banding from 75%-95%.

*The exception to the higher LTI are applicants wishing to consolidate debt, or those who have mismanaged their finances in the past – these borrowers will be restricted to an LTI of x4.