Another month and another EU directive for us to decipher, interpret and implement – I suppose I should be grateful that they are keeping me in work!

On the horizon (and coming up fast!) is the Insurance Distribution Directive (IDD). In fact, if truth be told, it’s here already. The final date for implementation is 1st October, but this date was extended from 23rd February, and firms, including our insurance partners have been preparing for these changes for some time now, so this probably isn’t much of a shock.

You may recall that we spoke at our National Training Event last November about the impact of the Insurance Distribution Directive. I used this opportunity to highlight the key changes that will affect us in the intermediated sales space as a network and as advisers.

So now, with less than a month to implementation I want to remind you of some of the changes that will take place and draw to your attention the impact that you may experience.

But first, let’s consider the reason why we are having these changes.

Background

The Insurance Distribution Directive (IDD) replaces the Insurance Mediation Directive (IMD).

This change in regulation is in line with the FCA’s statutory objectives (that of providing an honest, fair and effective financial marketplace). As with the IMD, the IDD aims to enhance consumer protection when buying insurance – including general insurance, life insurance and insurance-based investment products. Additionally, it also aims to support competition between insurance distributors.

Like the IMD, the IDD covers the authorisation, passporting arrangements and regulatory requirements for insurance and reinsurance intermediaries. However, the application of the IDD is wider, covering organisational and conduct of business requirements for insurance and reinsurance undertakings. The IDD also introduces requirements in new areas, including product oversight and governance.

It should be noted that this is a European Directive, but has been adopted in UK law, meaning that regardless of the outcome of Brexit, IDD is here to stay.

So in effect, this is new legislation, here to stay and aimed at improving consumer protection, experience and outcomes. Here are the changes:

Additionally, firms are required to keep up to date records of their advisers.

I am pleased to say that our requirement for 3 hours CPD per adviser per month is already in advance of this and our current policy is therefore suitable and there is no further impact to be felt in this area by our advisers.

- “A firm must ensure that it and each relevant employee possesses appropriate knowledge and ability in order to complete their tasks and perform their duties adequately.” [SYSC 28.2.1 R]

- “A firm must ensure that it and each relevant employee complies with continued professional training and development requirements in order to maintain an adequate level of performance corresponding to the role they perform and the relevant market.”

- “A firm must ensure that each relevant employee completes a minimum of 15 hours of professional training or development in each 12 month period.”

- All CPD must be relevant to the role being performed.

So, in short, there must be a clearly detailed process that documents an adviser’s competence, both how it was established and how it is maintained. Ongoing training is central to this purpose. Our current T&C scheme allows for this, but you should ensure that these competency standards are in place within your own business and that competency is taken seriously within your firm.

SYSC 28.3 goes on to explain the competence requirements for advisers depending on the products they sell; here is a brief summary:

General Insurance

- Minimum knowledge of the terms and conditions of the product and the associated risks;

- Minimum level of knowledge of the laws and regulation governing the distribution of insurance products;

- Knowledge of the claims handling process;

- Knowledge of the complaints handling process;

- Knowledge of how to assess customer needs;

- Knowledge of the insurance market;

- Knowledge of expected business ethics and standards;

- Financial competence standards.

Long-Term Insurance Contracts

- Minimum knowledge of the terms and conditions of the product and the associated risks;

- Knowledge of applicable insurance contract law, consumer protection law, data protection law, anti-money laundering law and, where applicable, relevant tax law and relevant social and labour law (i.e. state benefits);

- Knowledge of the insurance marketplace (and other relevant marketplaces – i.e. mortgage marketplace when selling mortgage protection products);

- Knowledge of the claims handling process;

- Knowledge of the complaints handling process;

- Knowledge of how to assess customer needs;

- Conflict management;

- Knowledge of expected business ethics and standards;

- Financial competence standards.

Now is a good time to review these competence requirements with your firm and ensure that your current T&C scheme within the business is fit for purpose. Your compliance manager will be looking into this on their next round of visits.

All records of staff competence and the associated training and competence files should be held for not less than three years.

- €1,250,000 applying per claim per year, and;

- €1,850,000 per year in aggregate for all claims.

Needless to say, our PI cover is in excess of these requirements.

We are satisfied that our current complaints process meets with the requirements of the regulator as outlined in the dispute resolution guidance, however, it is worth mentioning that where a complaint comes in and relates to a customer who has been serviced under passporting rights (if you don’t know what this is, don’t worry as you probably don’t have them!), they will be treated in the same way, but there may also be further obligations depending upon the rules of the Member State where passporting rights are held.

- Firms must act honestly, fairly and professionally in accordance with their customers’ best interests;

- Firms must communicate in a way which is clear, fair and not misleading;

- Marketing materials must be clearly identifiable as such;

- Remuneration of a firm or its employees, and performance management of employees, must not conflict with the duty to act in in accordance with their customers’ best interests.

The above principals have resulted in the creation of a new “Customer’s best interest rule”. This rule has meant some changes to the guidance in ICOBS 2. The key point to remember is that we now have to act with the customers best interests in mind and not pay “due regard” to customers interests; thus firming up the commitment to consumers.

Expect to see a number of changes to the FCA handbook, particularly in ICOBS. Here are some of the key chapters:

- The IDD General Principles (ICOBS 2)

- General pre-contract disclosures (ICOBS 4)

- Disclosures relating to conflicts of interest and transparency (ICOBS 4)

- The means of providing information (ICOBS 4)

- Standards for advised and non-advised sales (ICOBS 5)

- Cross-selling (ICOBS 6A)

- The FP must continue to be clear, fair and not misleading;

- Any promotion that does not fit the above statement, must be removed from circulation as soon as is practicable;

- Be consistent with the expected result;

- State the basis of any claims;

- The FP must comply with all other legislation.

- Changes to general pre-contract disclosures;

- Changes to the disclosures covering conflicts of interest and transparency;

- Introduction of disclosures concerning the firm’s remuneration;

- Changes to the rules on how information is provided.

This section is, quite possibly the most interesting of the IDD changes and arguably the most likely to impact upon our advisers. Below is a ‘taster’ of the disclosure requirements and I have expanded on the key areas in other sections, however, we will be expanding on these changes through our compliance visits in due course.

In terms of pre contract disclosures, they are quite close to the current Insurance Mediation Directive guidance:

- Firms must disclose whether they are an insurer or an intermediary;

- Intermediaries must make disclosures about shareholding links between the intermediary and any insurers;

- Firms must disclose whether or not they provide advice;

- Where intermediaries do not provide advice on the basis of a fair and personal analysis of the market, they must disclose the names of insurers with whom they may place business;

- Intermediaries must disclose whether they act for the customer or the insurer;

- Intermediaries must disclose the nature of their remuneration in relation to the insurance contract and whether they work on the basis of a fee, commission or some other form of remuneration (or a combination thereof).

All firms must disclose fees payable by the customer in cash terms.

The IPID is a specifically templated document that all non-life “product manufacturers” are entitled to provide to a consumer. This document replaces the outgoing policy document and is a short summary of the policy.

The IPID document applies to new product sales and renewals, but does not incorporate commercial sales.

An IPID must be provided per policy, with the exception of a pure protection contract.

What information needs to be contained in the IPID?

The IPID must contain the following information:

- Information about the type of insurance

- A summary of the insurance cover, including the main risks insured, the insured sum and, where applicable, the geographical scope and summary of excluded risks

- The means of payment of premium and the duration of payments

- Main exclusions where claims cannot be made

- Obligations at the start of the contract

- Obligations during the term of the contract

- Obligations in the event that a claim is made

- The term of the contract including the start and end dates of the contract

- The means of terminating the contract.

This, along with other guidelines for providers will be taken care of by the product provider, but you have an obligation to verify the accuracy of any documentation provided to your clients.

How must the IPID be presented and formatted?

The IPID must:

- Be a short and stand-alone document

- Be presented and laid out in a way that is clear and easy to read, using characters of a readable size

- Be no less comprehensible in the event that, having been originally produced in colour, it is printed or photocopied in black and white

- Be written in the official languages, or in one of the official languages, used in the part of the Member State where the policy is offered or, if agreed by the consumer and the insurance distributor, in another language

- Be accurate and not misleading

- Contain the title ‘insurance product information document’ at the top of the first page

- Include a statement that complete pre-contractual and contractual information on the product is provided in other documents

Additionally, the insurance product information document shall be set out on two sides of A4-sized paper when printed, or where a product manufacturer can demonstrate as necessary, the insurance product information document shall be set out on a maximum of three sides of A4-sized paper when printed.

Where an IPID is required, a policy summary is no longer required. As a result firms will no longer be permitted to use the Key Facts Logo when the IPID is introduced.

The FCA expect it to look something like this:

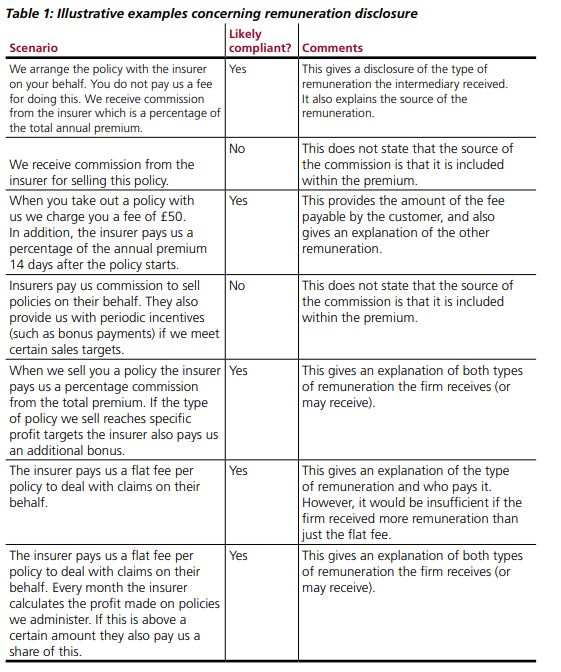

So what is classed as remuneration? The FCA says: “The IDD definition of ‘remuneration’ includes commission, fee, charge or other payment, including an economic benefit of any kind or any other financial advantage or incentive offered or given in respect of the insurance distribution activity.” Or to put it another way, any payment (or remuneration) to a firm or its advisers must not conflict with a consumers best interests.

The IDD requires insurance intermediaries to disclose the nature and basis of the remuneration they receive in relation to the insurance contract.

Nature – This is the type of remuneration that will be received or paid. This includes commission, bonus, profit share or any other financial incentive.

Basis – This requires firms to disclose the source of their remuneration.

Additionally, firms should disclose information about remuneration which has a direct connection to the insurance contract being sold. This is likely to include bonuses for hitting a sales target (where the specific contract sold will count directly towards that target) but may not include measures such as rewards for adherence to quality standards.

The purpose of these requirements is to highlight potential conflicts of interest and to promote transparency. Firms should ensure they disclose the information in a way that is useful to their customers in showing the relationship between firms in the distribution chain, and in highlighting potential conflicts of interest.

Where an IPID is required, a policy summary is no longer required. As a result firms will no longer be permitted to use the Key Facts Logo when the IPID is introduced

The IDD sets out new provisions on how information must be provided to customers. In summary, the requirements are:

- The information must be provided in a clear, accurate and comprehensible manner, in an official language of the Member State and free of charge;

- Information may be provided on paper, a durable medium other than paper or a website (where it is not a durable medium and satisfies certain conditions);

- Where information is provided through a medium other than paper, the option to have the information on paper must be available and free of charge;

- There is no provision for the information to be provided orally at the request of the customer;

- Telephone sales should comply with existing EU law in relation to distance marketing.

Therefore, for those of you who transact insurance business over the phone, there is a requirement for you to supply remuneration (and other disclosure data) in a ‘durable medium’.

Insurers and advisers are also warned about how they remunerate their employees. Importantly, their remuneration policy must not conflict with their duty to comply with the customer’s best interests rule.

SYSC will outline a new rule that prohibits remuneration and performance management practices that would conflict with the “customer’s best interest” rule.

This principle extends to soliciting or accepting inducements where this would conflict with a firm’s duties to its customers. Particular consideration therefore needs to be given to any inducements that you may solicit or receive from one product provider over another; however, this is something that we are already familiar with as we follow a strict bribery and inducement policy as detailed in the Compliance Manual.

The FCA also details specific conflicts of interest that require attention and particular transparency:

- Intermediaries must disclose if they have 10% or more voting rights or capital in an insurer, or vice versa. Currently the requirement is “more than 10%” – Not a particularly significant change then;

- Intermediaries must disclose if they give advice based on “a fair and personal” analysis of the market;

- Where an intermediary is contractually bound to place business with a specific insurer or insurers it must provide the names of these insurers. Currently this information need only be supplied on request by the customer;

- Where an intermediary is not contractually bound to place business with specific insurers but does not provide advice on the basis of a fair and personal analysis of the market, it must name the insurers with whom it may place business. Currently this information need only be supplied on request by the customer.

The IDD requires insurance intermediaries to disclose the nature and basis of the remuneration they receive in relation to the insurance contract. Insurers must likewise disclose the “nature” of the remuneration paid to their employees. Where the remuneration is in the form of a fee paid by the customer, the amount of that fee must be disclosed. Firms are permitted to disclose the method of calculation instead of the actual amount, but only if the amount cannot be calculated at the time.

Expect to see ICOBS 4 updated very soon to reflect these changes – we will then issue further guidance.

The key thing to remember is that both insurance providers and advisers will need to have specific measures in place to identify, document and assess any potential or actual conflict of interest.

Put simply, a durable medium is in paper format, or can be by electronic means such as an email, but only if it can be proven that the client has consented to being provided the information in this format and if there is evidence that the client has regular access to the internet. The provision by the client of an e-mail address for the purposes of the carrying on of that business is sufficient.

Your responsibility is to ensure that you are familiar with this new legislation and are ready to comply. You may wish to start by conducting an impact assessment on your business and then plan to implement the directive.

The key areas that you will need to focus on are:

- Training and Competence of your staff;

- Understand and have written down your remuneration policy, including bonus structure;

- Adopt a conflict of interest policy (view the networks conflict of

interest policy here); - Liaise with providers to see what approach they are taking to IDD and how it will impact upon how you submit business to them.

I appreciate that there is a lot to take in here. The good news is that we are on hand to provide support and guidance through the transition. If you have any concerns, please speak with your Compliance Manager.