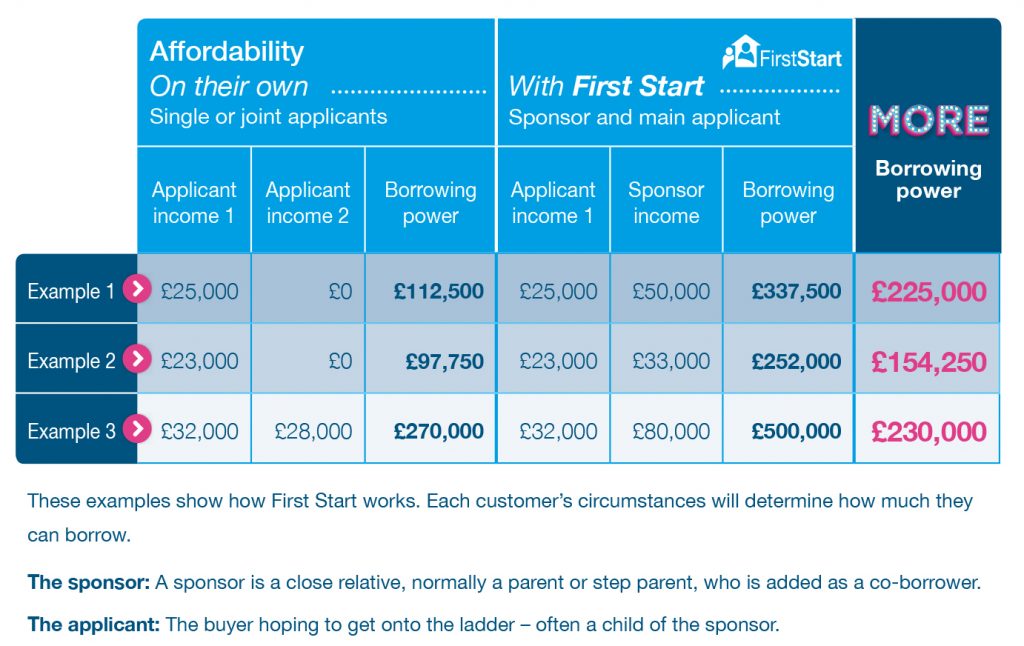

Giving your first time buyers more borrowing power.

First Start boosts the borrowing power of buyers, by combining their income with that of a sponsor*. So together they can borrow more, responsibly.

Together, the sponsor and applicant can borrow up to 95% of the value of the property. It’s available for purchases only on a repayment basis, up to £500,000.

Both parties are co-borrowers, making them jointly and individually liable for the monthly mortgage repayments, as well as the total mortgage loan.

Here’s some key First Start criteria at a glance:

- Up to 95% LTV

- Maximum age of sponsor 80 years at the end of term (60 at outset)

- Maximum loan £500,000

- The sponsor must be a residential owner occupier living in the UK and a parent or close relative of the applicant

- The sponsor can choose not to be a joint owner of the property which can reduce Stamp Duty liability (independent legal advice is required. We highly recommend independent financial, legal and tax advice is taken in all cases.)

- Minimum incomes: applicant £20,000, sponsor £30,000

Head to boi4i.com to find out more

*A sponsor is a close relative, normally a parent or step parent of the applicant