There are clients who believe that protection cover is expensive not a priority, but spelling it out to them with the cost of their mortgage and what it means to be unable to cover it is key to focus them. That’s the thinking behind the latest enhancement to SolutionBuilder – The Mortgage & Protection Risk Report.

The Mortgage & Protection Risk report

Life can change very quickly and when you’re not expecting it. If the worst were to happen to your clients, how would they look after their families and protect their homes? You’ve heard it all before but there is still not enough done to ensure people taking out mortgages have cover in place.

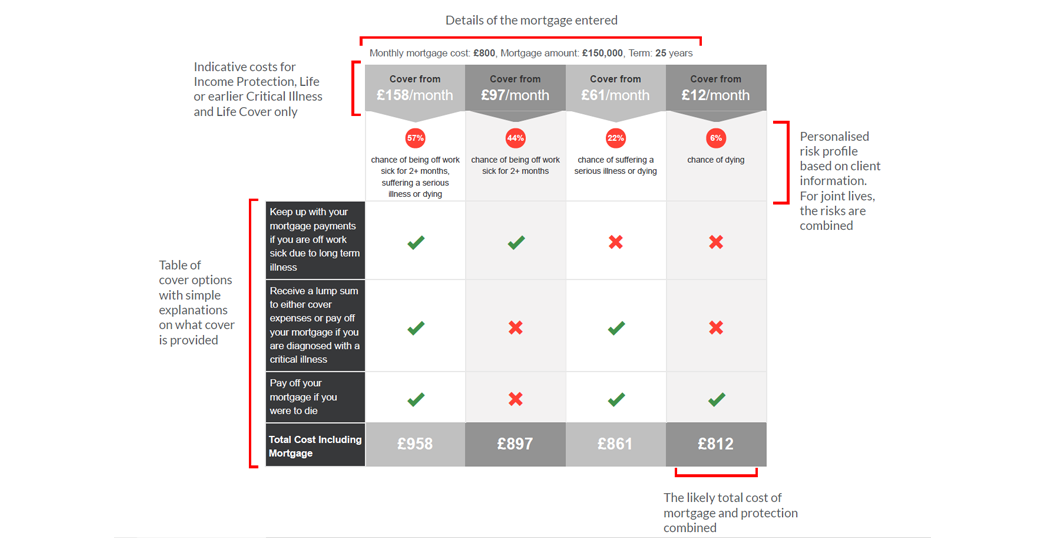

That’s why we have developed a simple to use new feature within SolutionBuilder called The Mortgage & Protection Risk Report which helps tackle this problem. The report generates a table with indicative costs for Income Protection, Critical Illness Cover and Life Insurance, on top of the monthly mortgage amount.

The report can be used at any point in the mortgage or protection sales process as a means to nudge clients. Providing information in a clear, easy to understand format by cutting out all the jargon whilst highlighting the likelihood of needing each type of cover.

What would happen to their house if they became too ill to work and couldn’t keep up with mortgage payments? How would they cover their living costs if they became seriously ill? If they were to die, how would their family cope financially?

In the report, cover for these options and combinations of each is available with indicative costs next to each one. This is not just a generic ‘cover from £10/month’ figure but takes into account the client’s age, smoker status, employment and mortgage details. Although it is not a ‘real’ quote, it educates the consumer that protection can be affordable – something they aren’t always aware of.

Highlighting the cost of protection in a clear, easy to understand format is vital to closing the protection gap. As well as ensuring your clients, who may not realise what it means if you are not adequately covered, exactly what could happen – and the likelihood of it – in the event of being unable to work or death.

The Mortgage & Protection Risk Report is available to launch from the benefits selection screen in SolutionBuilder.