The Product Transfer and Re-mortgage Opportunity

If you haven’t already been in touch with your clients then now is your opportunity.

According to a report produced by Barclays*, between July and December 2024 over £98.4 billion worth of residential mortgages and £16.4 billion worth of buy-to-let deals are coming to the end of their terms. With the largest spike in October 2024.

As a result, lenders are anticipating a surge in remortgage applications.

This is great news for advisers with the opportunity to speak clients whose fixed terms are coming to an end over the next few months. Remember, there are validity periods which allow you to lock in fixed rates for customers several months before their fixed mortgage ends.

Now is the time more than ever when clients need the expertise of advisers to help them navigate through all options available to them. Should they go ahead with the product transfer, or is a remortgage option for them?

Even if your clients mortgage is not coming up to the end of the fixed term, pick up the phone to them. Have their circumstances changed? Do they need a review of their protection? How will they pay their mortgage if they are unable to work? We know affordability can be a hurdle. Remember to customers this a maze.

*from mortgage market analysis CACI Ltd, as at February 2024

Latest News

Get in touch

Anita White

Head of Lender Relationships

Equity Release and Acre; a great combination!

With the introduction of Acre this month to all of our advisers, it is exciting times ahead for us in the Equity Release department.

Although Acre will be making life easier by being online, it will also be working in the same similar ‘secure filing cabinet’ as The Key. However by the end of the year we will be having the exciting development of having a interactive fact find on Acre with an end to end system. We will keep you notified on the progress!

And did you know?…..We are on Spotify!

Listen to our latest Podcasts from all areas from Lending, Protection and to Later life lending. These podcasts are free and available to you while you work and travel so click on the link and follow us for more updates!

Latest News

Get in touch

Victoria Clark

Head of Equity Release

Think deeper about the numbers

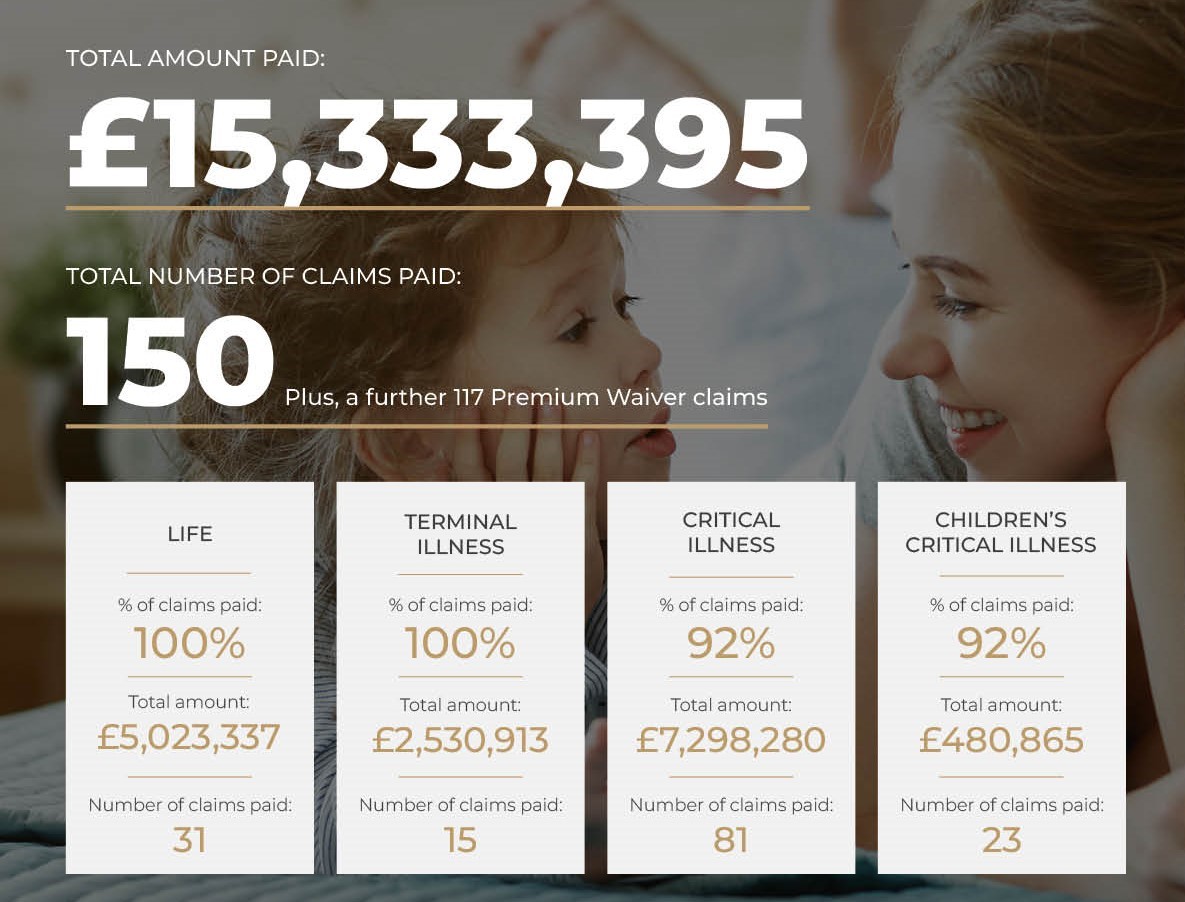

Following on from the Guardian Claims Report 2023 released this month, a quick look at the figures revealed a huge amount of claims paid out totalling just over £15 million.

On the face of it, these figures are reassuring that indeed Protection and Critical illness cover is doing what it is designed to do; pay out and protect the client at their time of need.

However, as an adviser, do you ever stop to take stock of what the figures really represent?

If in a year over 150 claims were paid out (not just made) and Guardian only cover around 2.9% of our provider market share, what is the true reflection of the UK population and what is the true amount paid out for critical illness cover? And what’s more….what does this say about the sheer amount not covered?

As the experts, think a little deeper about the data that is being presented to you, look at it critically and ask yourselves the difficult questions. If you gain a greater knowledge of the situations, products and providers you are in a better position to make sure your clients get all the information so they can make informed decisions. Time to start thinking critically about critical cover!

Latest News

Get in touch

Amanda Wilson

Company Director

Brush up on your PMI stats

Following on from our very successful PMI summit and gala dinner, I thought it would be good to share some of my statistics that give some weight to when you speak to your clients. Going through some factual statistics to reinforce the information that you are providing can make all the difference.

Below I have listed some interesting statistics for you, that you may find useful to use, when speaking to your clients. To access the full presentation, please visit the Right PMI link in our PMI hub on the TRM website.

- 29% of the UK population are still using their disposable income to fund their private healthcare treatment and 24% are still using their savings. This can be alarming; your client shouldn’t need to be exhausting their savings to fund their treatment. Which then brings me on to my next point.

- One knee replacement can cost from £11,814 (this is excluding any scans/xrays) a hip replacement could cost from £10,776. Does your client really want to be exhausting their savings on having one condition sorted out, when the chances of them occurring another condition in a short time frame is highly likely?

- There is a minimum eighteen week waiting period to receive your first appointment at the hospital, from when you have been referred by your GP.

- The average age of a client taking out a private medical policy within the UK is now 34. Younger and younger people are showing a keen interest in PMI and protecting their health.

We are always on had to help, so if you have any thoughts or questions, don’t hesitate to get in contact with our team.

Shout out corner:

My favourite bit, because we get to celebrate you! A big congratulations first of all to our winners at the PMI gala. Your hard work and determination does not go unnoticed, so we are so pleased to recognise your achievements:

You can view the event’s gallery and see the day’s presentations on our dedicated page here >>

Competition winners:

Congratulations also to Roy Allaway; he is the lucky winner of a signed Liverpool FC shirt. The competition was run by AXA health and advisers had to guess the amount AXA Health pay out for claims each working day….the answer is in fact a staggering £4.9m.

Another little well done to Lucy-Anne Jenkins who works with Hans Jenkins. She is the winner of £250 Amazon vouchers from the prize draw held by William Russell.

Key Links:

Dedicated section for PMI advisers

PMI Adviser only Forum Hit ‘subscribe’ in the top right hand corner to keep up with all our latest topics.

Key Dates:

Latest News

Get in touch

Bipin Sandhu

PMI Supervision & Development Manager

Maximise your GI sales by simply clicking a button

Have you had chance to have a look at how seamless GI can be now we have Acre? No more excuses you don’t have the time or knowledge, with uinsure CX you can either auto-refer every customer, or you can simply click a button every time you want to refer.

Uinsure CX uses key milestones of the mortgage journey to remind your clients of the importance of GI, ensuring it’s all in place early in the journey.

- See how easy it is to use by clicking here to watch our Cross Sales Tour on Vimeo

- Activating UinsureCX in Acre

Have a little look at the links and the PDF below for more details.

Latest News

Get in touch

Amy Wilson

Head of General Insurance (PMI and GI)