I am pleased to confirm that today we have made a couple of significant enhancements to our Lending Policy and Underwriting Processes, which I hope will make both the advisor and customer experiences more straightforward when submitting business with Kensington, and signify yet another step closer to everything returning to something resembling normal.

First of all, we are removing the Underwriting requirement for customers to evidence 3 months’ worth of mortgage payments in their bank account prior to offer for ALL CUSTOMERS. This was always designed to be a temporary measure, and was a reflection of the unprecedented times we’ve found ourselves in, so I am pleased we are now able to move forward without this requirement.

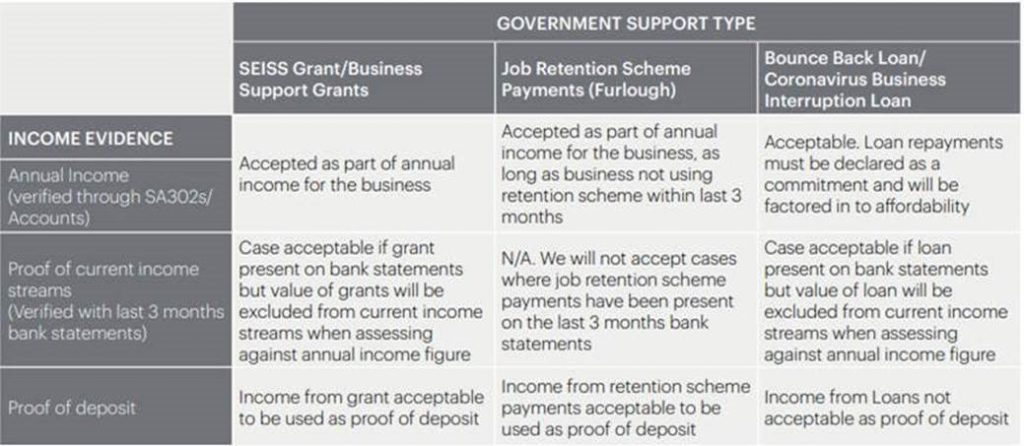

Secondly, we have reviewed our Self-Employed proposition in line with various Government support schemes / funding that have been available during the COVID-19 pandemic, and as such I am pleased to share the news that the following income sources will now be accepted as part of Self-Employed Customers’ income

- SEISS Grants / Business Support Grants

- Job Retention Scheme Payments & Bounce Back Loans

- Coronavirus Business Interruption Loans

Please note, we will not accept any cases where the business has employees on furlough currently or at any time in the last 3 months

To further aid your understanding our Self Employed proposition and acceptable income streams, please see the useful table below.