Do you have clients approaching or in retirement who may be struggling to pay off their interest only mortgage?

Hodge can help

Often, people are put off approaching their Adviser about later life borrowing as they don’t believe they will be able to borrow enough money to repay their existing mortgage. This this is especially prevalent for those age 65 or under as with standard equity release, available LTVs are often simply not high enough to give the amounts required.

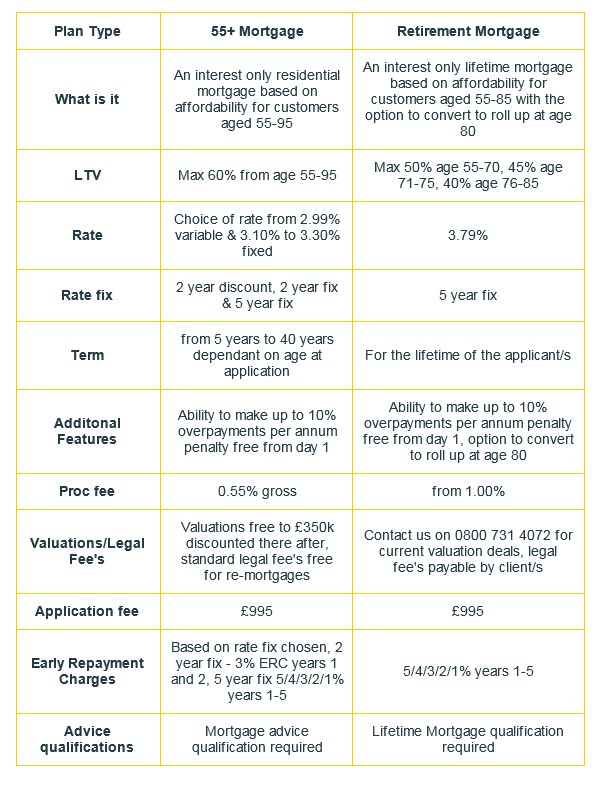

There are solutions, Hodge offer two interest only mortgages, one residential one lifetime, with LTV’s of between 50% and 60% at age 55. Both products are based on affordability both pre and post retirement and we accept income streams such as employed, self-employed, rental, investment and pension.

Contact our Adviser support team for more information on

0800 731 4076 or visit our website by clicking on the button below for an affordability calculator and a selection of document downloads