|

At LV=, we have a range of income protection products that you can recommend to self-employed clients, helping protect them if illness strikes. Please contact me for more information or visit the income protection section at our website.

Kind regards

Stuart Mair

T: 07968 538 514

E: Stuart.Mair@lv.com

With all our personal protection products we include access to the LV= Doctor Services app. This gives your client’s fast, convenient access to three expert medical services: Remote GP, Prescription Services and Second Opinion.

Many advisers (and clients) are surprised at just how easy it is to use the LV= Doctor Services app – take a look at the short demo video below.

And don’t forget you can share the video with your clients to help them see how simple and convenient the app is.

What’s in it for you and your clients?

|

|

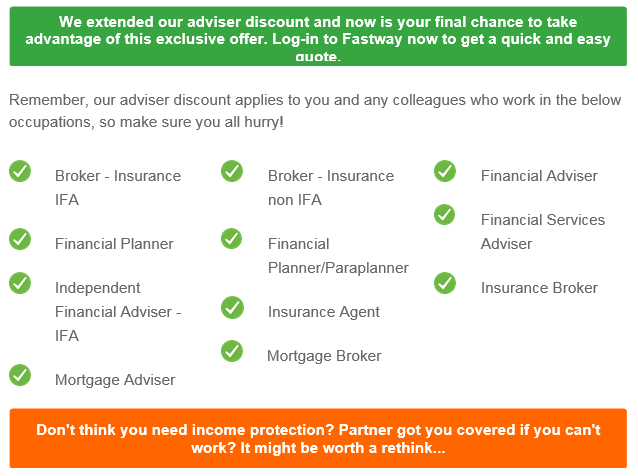

This is your final chance to take advantage of our discounted premium* (automatically applied to the full length of the policy) when you apply for LV= Income Protection through Fastway.