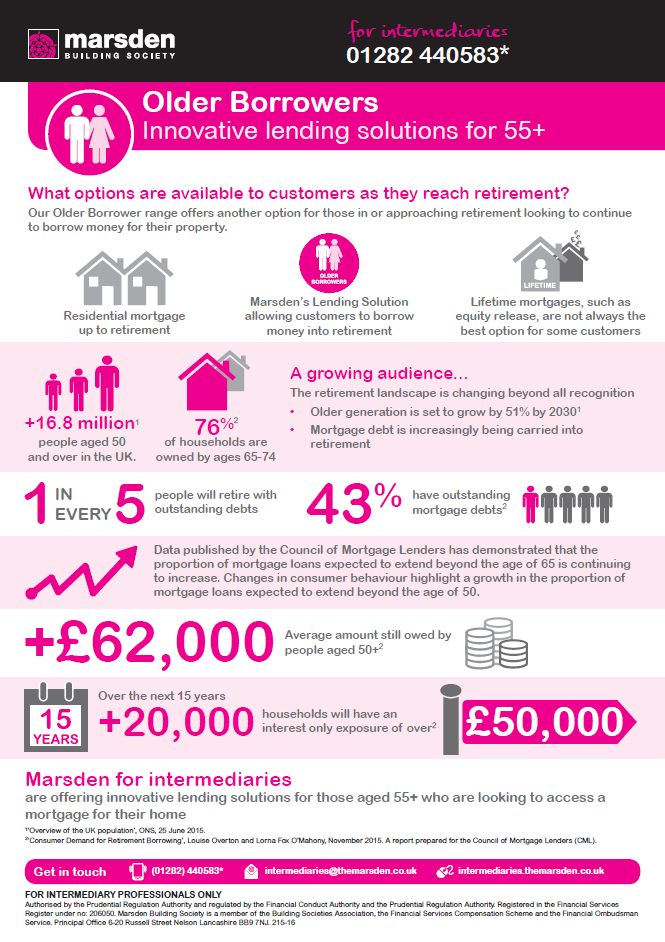

The retirement landscape is changing beyond all recognition… but where does it leave those customers in or approaching retirement who still want to borrow money on their property?

ONS data highlights that the 50+ is a growing population and demonstrates the need to know more information about these customers…

Are they still looking for borrowing solutions?

Do they have a regular pension income?

Are they able to find support for their situation?

A study on the ‘Consumer Demand for Retirement Borrowing’ by Louise Overton and Lorna Fox O’ Mahoney demonstrates a fast changing market.

- Older generation is set to grow by 51% by 2030

- Mortgage debt is increasingly being carried into retirement

- 1 in every 5 people will retire with outstanding debtsClick here to view the Older Borrower fact sheet

So what is the solution?

With a growing +50 audience there is, as a result, a growing demand for Older Borrower mortgages.

Steve Robinson, Head of Lending “We’ve found that customers and their advisors were struggling to source a mortgage that meets their needs in retirement. If they pass our Older Borrower affordability model and meet the Society’s requirements, there is no reason, as a responsible lender, we should not be supporting these customers.”

“For some people, a lifetime mortgage isn’t the solution and instead they are looking for a conventional residential mortgage that they are able to keep up a repayment on – which is exactly what we’ve built with our Older Borrower range”.

Get in touch…

Visit the Marsden’s website for more information on product or criteria:

www.intermediaries.themarsden.co.uk

Call their intermediary support team 01282 440583

Or drop them an email on intermediaries@themarsden.co.uk