Nationwide are always looking for ways to help you package cases successfully, and some of their most frequently asked questions are around tax calculation proofs for self-employed clients.

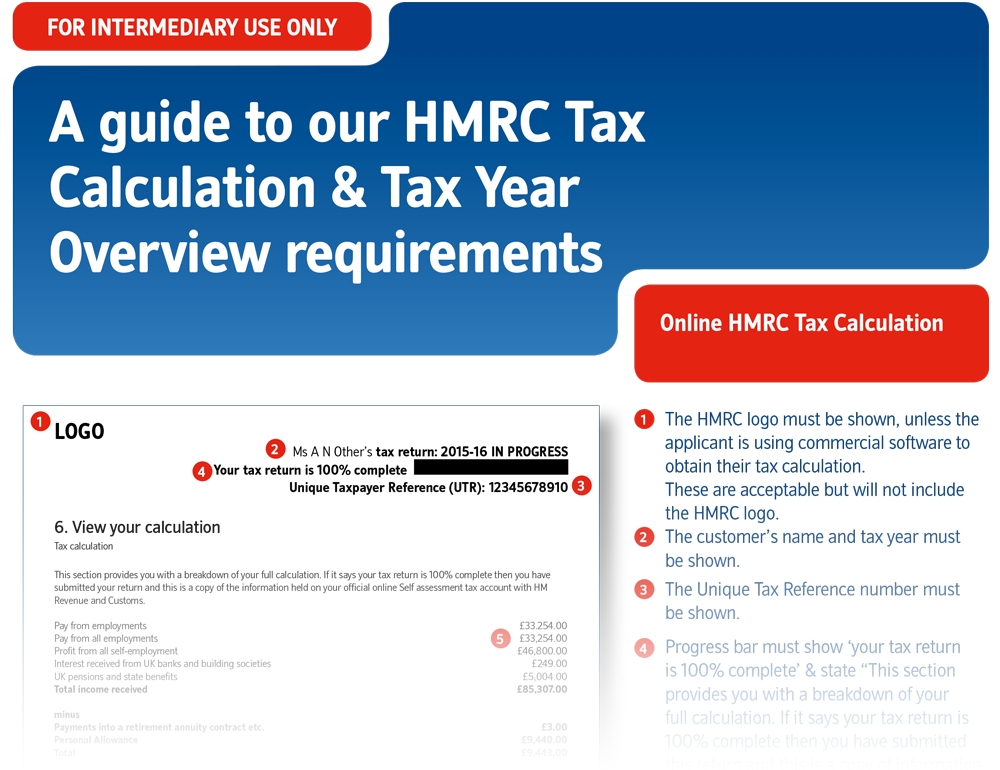

You’ve asked for clarity around self-employed income proofs, so Nationwide have produced a guide to their HMRC Tax Calculation & Tax Year Overview requirements, which also includes illustrative proof examples for your reference.

Click the preview below for the full guide and to download a copy:

Help and Support

If you have any questions, please contact your local BDM or your regional Dedicated Broker Support team through Broker Chat or on 0800 545 3131.