The dynamic state of the current mortgage market

There’s a lot of rate movement with lenders at present. Many views are predicting another base rate cut in November, possibly a further one before the end of the year? In addition, we could see fixed-rate mortgages reaching their lowest levels in two years.

Feedback is indicating clients are starting to engage more and we’re seeing more First-time buyers and home movers. Which is brilliant news for the housing sector, the network and our advisers.

Let’s see what impact if any the Autumn Budget has on our industry.

Looking at the remainder of this year, the market will finish on a high compared to the predication at the beginning of 2024. Although it’s early, indications for 2025 are circa £381bn

Turning to the housing market, the activity remains strong, but according to Rightmove the muted Autumn price increase comes as buyer choice and seller competition rise.

“The number of sales being agreed is up by 29% year-on-year while the number of people contacting agents about homes for sale up by 17% compared with this time last year.

The number of available homes for sale is 12% higher than a year ago, and represents the highest per estate agent since 2014.

Their data shows that the outlook remains positive for 2025, but affordability pressures remain, and some buyers may be waiting for Budget clarity and cheaper mortgage rates before acting.

Sellers need to be pricing competitively to find a buyer, particularly with affordability still very stretched.”

“Some sellers appear to be acting on this caution, contributing to limited price growth and better buyer affordability. This is helping to keep the number of sales being agreed consistently and strongly ahead of the quieter market of this time last year.”

It’s like playing a game of chess, waiting for the other person to react before making the move!

Don’t miss this months Mortgage podcast!

Listen to our latest Podcasts from all areas from Lending, Protection and to Later life lending. These podcasts are free and available to you while you work and travel so click on the link and follow us for more updates!

Latest News

Get in touch

Anita White

Head of Lender Relationships

Celebrating our advisers

In October we launched our Later Life Lending Accredited Adviser initiative, in partnership with Air Group.

A Later Life Lending Accredited Adviser (LLLAA) is an adviser within The Network that offers a holistic approach to their later in life borrowers. Our LLLAA members are able to review multiple lending areas of the market and really provide their customers the correct solution for their needs. Whether that be; Lifetime Mortgages, Payment Term Lifetime Mortgages, Retirement Interest Only Mortgages, Mortgages or likewise. Not only are they able to offer a full product review for their customers; they are also doing so at a high quality, with an over 80% file grading throughout their cases. A LLLAA is also a member of The Network that gets involved at events and development, sharing their wealth of knowledge with others.

We were able to celebrate this small group of advisers at our celebratory launch dinner with Air!

If you want to get know how you can be a member of this accreditation next year, please get in touch with me or a member of the team.

Latest News

Get in touch

Victoria Clark

Head of Equity Release

Protection: What are people Googling?

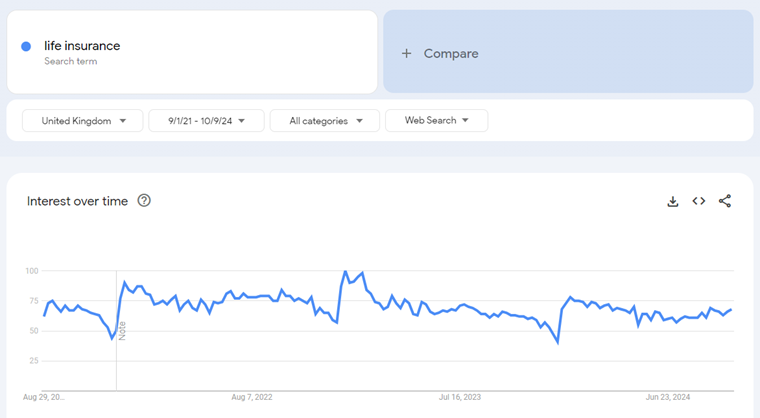

Life Insurance

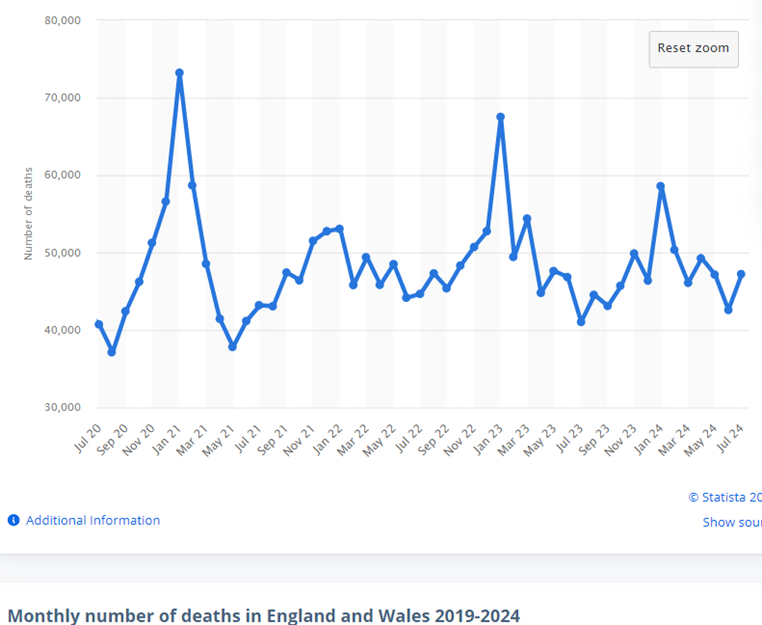

- Peak search period is just around the corner with the festive period quickly sneaking up on us. A combination of people spending wholesome time with the family and January having the highest number of deaths per month over the last 3 years means the population are more interested in Life Insurance at the start of year than at any other time.

- Get marketing plans in action now for January. Market before the search rush to be the first thought in a person’s mind. Nothing to stop a firm from automated marketing even if a firm does close for a few weeks over that time of year.

- Digital marketing and consumer engagement tools could go a long way!

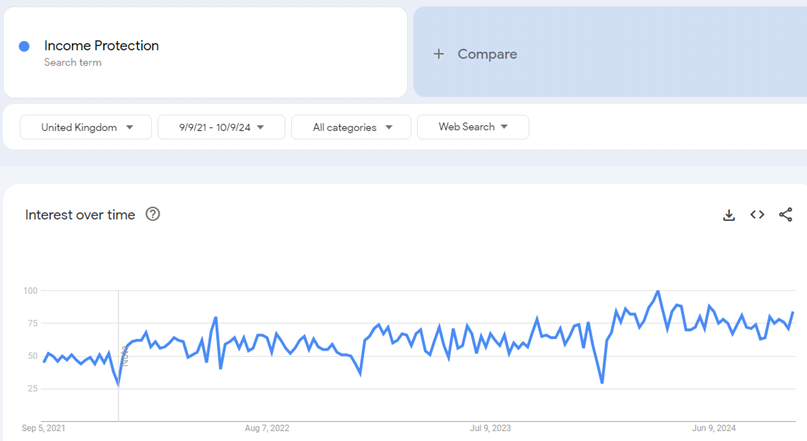

Income Protection

- A hugely positive trend line with more searches than ever year on year

- With more searches than ever for IP, chances are the population are more educated and as a result more likely to appreciate the benefit of it. Identify those that don’t have IP currently and market to them with specific messaging. Campaigns are likely to be successful.

- Can you use hot topics in the news, such as interest rate changes to drive home the need to them protect income? Dropping rates (upcoming budget may change this) are seen as a positive but they can also act as a reminder that financial circumstances change.

- With winter months comes flu season. COVID, lockdown and general illness are still very much fresh in the memory.

Latest News

Get in touch

Amanda Wilson

Company Director

More Patients are taking out private medical insurance

Long waiting times are resulting in clients taking out private medical insurance. Almost seven in ten people are using their private health care, instead of the NHS.

A surprising number of young people are also willing to pay for medical attention, it has been estimated by the Private Health Care Information Network that 44% of 25 to 34 year olds are expected to use private health care in the coming year. While more than half of all 18 to 24 year olds who have used private healthcare in the past, did so to access private GP appointments.

The cost of a private GP appointment can cost between £29 to £150, which you may think is worth it, to be seen quickly. However, paying for private treatment can burn a sizable hole in your pocket. For example the average cost for a knee replacement costs £13,412, according to recent data from health insurance provider WPA.

When selling private medical insurance, it is worth informing your clients;

- There are no waiting times – Enabling your client to jump the queue and access treatment and diagnostic scans quickly

- Wider access to some treatments – Certain treatments that the NHS cannot afford to buy may be paid for by private medical insurers. For example, new cancer drugs that aren’t yet approved by the NHS.

- Avoid big one off costs – If your client doesn’t have the funds, paying for private treatment with their savings, could be a struggle.

- Wellness perks – some private healthcare insurers include extra benefits aimed at promoting a healthy lifestyle, such as discounted gym memberships or access to mindfulness apps

- Comfort and privacy – Patients can also expect to be treated and recover in the privacy and comfort of their own private room, giving them access to a wider choice of food and family visits, that are not available on the NHS.

Should you have any further queries or would like to discuss private medical insurance in greater detail, please feel free to get in touch.

Latest News

Get in touch

Bipin Sandhu

PMI Supervision & Development Manager

UK home insurance premiums have risen by nearly a third in two and a half years

Research carried out by the House of Commons library – found that home insurance premiums rose by a combined average of 31% between January 2022 and August 2024.

With articles like this, what is the perception that consumer’s have about their current insurance policies? We have a duty of care to ensure that when we speak to customers about their mortgage, they have a home insurance policy in place. With the cost of living not looking any easy, we need to make sure that our customers are fully protected from perils.

So what can we do?

- Obtain insurance renewal documents so you know they have a policy.

- Properly educate your clients on why home insurance premiums are on the rise.

- Ensure they have adequate cover, and it hasn’t been over inflated by inflation, or they haven’t undervalued it.

- Find out what in their home is important to them, and reassure them you will protect it.

- Ensure they have all the conditions they think they do, such as their excess.

The providers on our panel, as well as our team at TRM, can help ensure you have all the tools you need to be able to confidently have these conversations.

Latest News

Get in touch

Amy Wilson

Head of General Insurance (PMI and GI)