At last, a glimmer of hope for prospective homebuyers?

Recently the headlines have been dominated by rising mortgage rates, which has made it quite overwhelming for many people managing their monthly mortgage payments, along with the ongoing cost of living crisis.

Nevertheless, there’s some positive news on the horizon. Over the past few weeks, several major UK lenders have announced rate reductions, offering a welcome distraction from the gloomier reports we’ve seen earlier this year.

Looking ahead, it’s important to note that substantial decreases in mortgage expenses are unlikely in the near future. Inflation remains high, and the Bank of England anticipates that interest rates will stay elevated for an extended period. Nevertheless, these recent developments should not be underestimated, as it presents a glimmer of hope for those who are planning to refinance in the coming months, purchase their first home, or upgrade to a larger property.

What does this mean for you? These reduced rates create additional opportunities for you to discover a mortgage that suits your client needs, whether they’re considering refinancing, finding their dream home, or assisting a family member in entering the property market for the first time. The time is now to become savvy with the market and start to really understand your products.

The Network are well-equipped to help you navigate the mortgage market, just take the time to understand your clients unique situation and use the strength of the Network to help search through a wide array of financial products to help you find one that aligns with your clients circumstances, lifestyle, and financial objectives.

Listen to our latest podcast

Fleet Mortgages BTL as we go into 2024 – what’s going on podcast

Latest News

Get in touch

Anita White

Head of Lender Relationships

30th November 2023: Later Life Lending Annual Conference & Winter Masquerade Ball

We look forward to our Later Life Lending Annual Conference & Winter Masquerade Ball on Thursday 30th November 2023, for all of our equity release authorised advisers. It will take place at Hogarths Hotel, Four Ashes Road, Dorridge, B93 8QE.

The day will be full of round tables and presentations from our sponsors and talks from our directors. Then on to the evening for a night of celebrating the achievements of our advisers with our provider, solicitor and system partners. Count down is very much on!

You will need to register for the event or please get in touch on 01564 732 744 if you would like to find out more or to book your place if you haven’t done so already.

We look forward to celebrating our members success!

Latest News

Get in touch

Victoria Clark

Head of Equity Release

Check your knowledge against the FCA Financial Lives Survey

After a few more regulation changes, specifically consumer duty and foreseeable harm, it is great to see the joined-up thinking across the Network. By working together, we will have a positive outcome to ensure our customers understand they need to protect themselves and their homes. A gentle reminder that the insurance declaration document has to be on the files by the end of the month.

Recently we have been seeing all sorts of local news pieces on charity/crowding funding etc to help families who have financial difficulty, a lot of times due to illness or death. Is this just a reflection of the times we live in or is there something that can be done about it? For all of your customers, do you take the opportunity to discuss a protection policy and let them know what is out there?

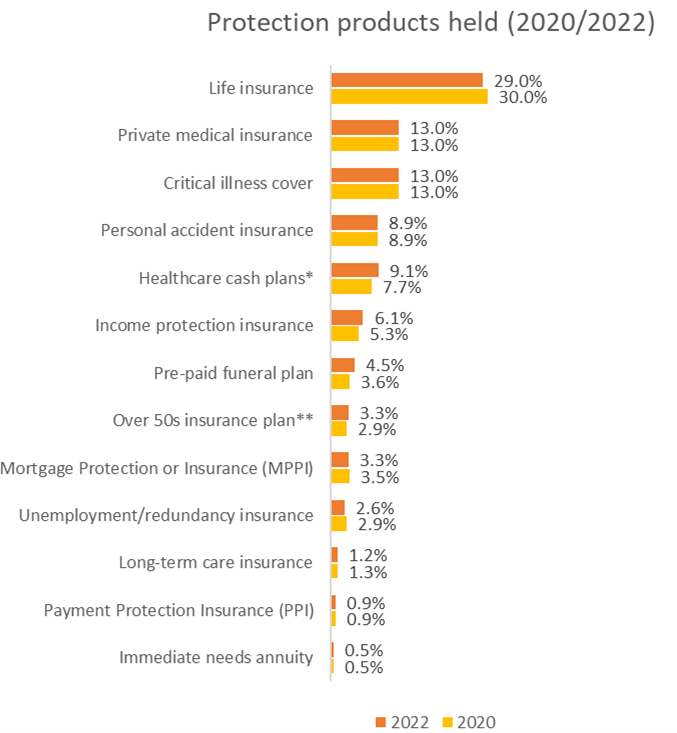

The recent FCA Financial Lives Survey reported the following percentage of UK adults that a hold a protection product:

* Including dental. **Also known as a guaranteed whole of life plan

Source: FLS Base: All UK adults (2020: 16,190/ 2022: 19,145)

To make sense of the data, only three in ten adults are covered by life insurance. A lot of life insurance policies have very real value-added benefits that people often forget about, so it’s important to remember to have a look or ask if your client needs the little things like a medical second opinion or 24-hour GP services, counselling services etc. One insurer calculated it would cost £24 per month if you utilise all of the ‘free services’ they offered. Now is the time to get ‘in-the-know’ about all these products and maybe you can be the one that offers the protection that your clients need.

Listen to our latest Podcast:

Retiring employees: The benefits of continuing private medical insurance policies

As employees approach retirement, they often find themselves facing a multitude of decisions and considerations. Among these choices (and one that should not be overlooked) is the continuation of private medical insurance policies. While many individuals may assume that employer provided health coverage ends with retirement, there are opportunities to retain and continue these policies.

The importance of private medical insurance in retirement.

One of the primary benefits of continuing private medical insurance policies in retirement is the smooth transition it provides. Retirees can often keep their existing cover without any disruption, ensuring they have access to the same healthcare providers, medications, and treatment they were accustomed to, during their working years. The continuity of care can be especially crucial as individuals age and require more frequent medical attention.

Private Medical Insurance avoids the long waiting times often had to be faced via the NHS. This is invaluable for retirees, who may be dealing with age-related health issues or chronic conditions that require prompt attention. By continuing their private medical insurance, retirees can avoid long waiting lists and receive the necessary treatment at a much faster rate.

Healthcare costs can be significant, therefore having the peace of mind of their medical costs being covered, having access to private treatment and access to faster care, enhances retiree’s overall quality of life and well-being. It is vital retirees should carefully review their existing insurance policies, consult their employers, advisers or insurance providers and consider continuing on their policies.

How many of you discuss this with members, leaving group schemes? A topic that can be discussed at our next coffee morning……..

Latest News

Get in touch

Bipin Sandhu

PMI Supervision & Development Manager

Think about the next thing you will be insuring

As general insurers, you will already be familiar with the usual things that people insure; home contents, buildings, cars and pets. It is always great to keep abreast of the products that are available to you, but just for fun here are a list of by far the rarest and strangest things people have had insured:

- Gene Simmons Tongue: In the late 70s, the band KISS known for face paint, show stopping antics, and one really long tongue! Gene Simmons, had it insured for a $1 million. Whilst we are at it, in another rock n’ roll move, Keith Richards of The Rolling Stones got his middle finger ensured for $1.6 million….well, he does play the guitar after all!

- A worker at Cadbury’s has her taste buds insured for £1 million. The policy has stipulations that she must avoid anything that would destroy her sense of taste….I know many people who could be quality taste testers for chocolate, but not at the risk of never eating another hot curry or hot chilli again!

- The super model Heidi Klum famously has her legs insured for a cool $2.2 million. The most bizarre part of the story is that one is more expensive than the other due to a small scar. Just so you know; one is insured for $1.2 million, and the other is insured for $1 million.

- Alien abduction. You would be wrong to assume this is an issue for our American friends in Roswell….apparently over 30,000 people all over have taken out insurance against alien abduction. I don’t believe anyone has ever successfully claimed against it though.

- Keeping in the ‘spirit’ of things; Ghost Insurance! After an alleged ghost sighting on his property, one British hotel owner took out a £1 million policy against death or disability caused by the spirit….spooky!

Something to think about next time you are offering your clients a bespoke service!

Latest News

Get in touch

Amy Wilson

Head of General Insurance (PMI and GI)