£3 billion is currently loaned with equity release annually, but according to our survey of advisers there are still some pervasive myths out there.

We asked 215 advisers about their clients’ understanding of their retirement funding options.

The myths

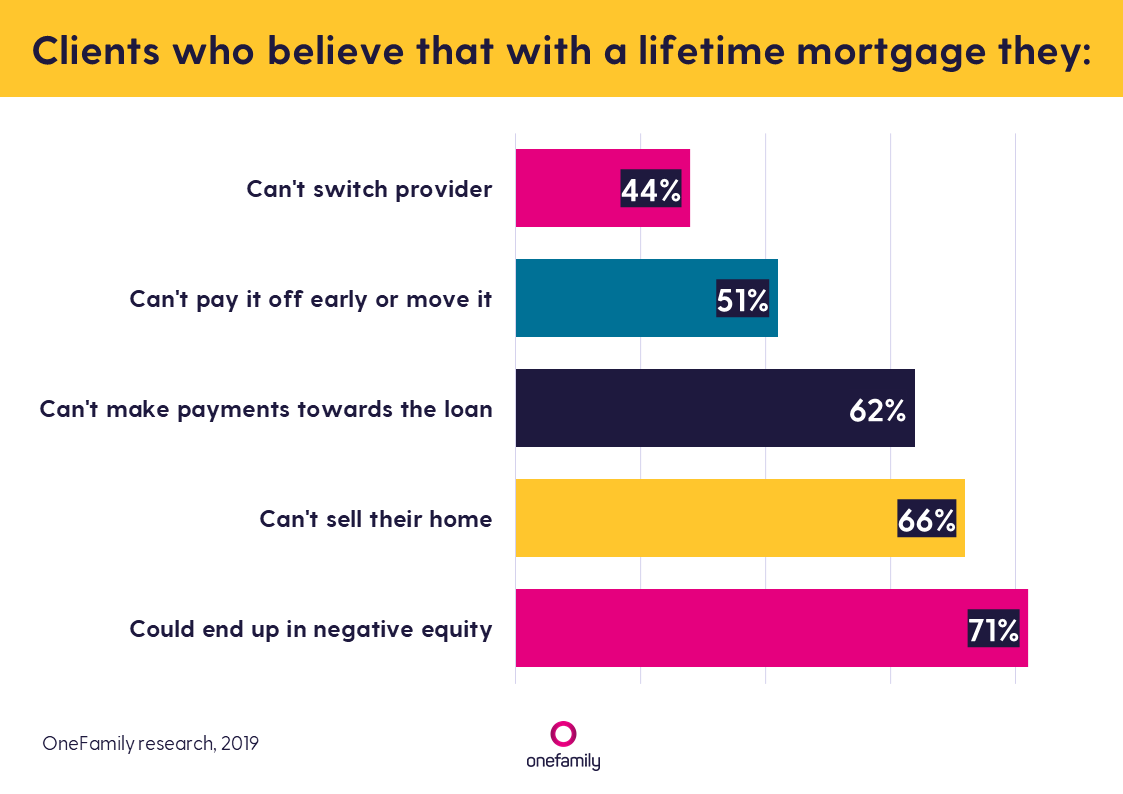

Advisers said that most of their clients thought they couldn’t pay off a lifetime mortgage early or make payments to reduce the size of the loan. Advisers said most of their clients thought it meant they could end up in negative equity and were unable to sell their home. None of which are true.

It’s important that people are well-informed about their financial options in retirement. As an industry these are myths we need to bust. Nici Audhlam-Gardiner, Managing Director of Lifetime Mortgages at OneFamily, said:

“This research shows there is a lot of misunderstanding in the later life lending market and demonstrates the value of taking financial advice. OneFamily supports advisers in helping customers identify the right solution for funding their retirement, with a range of lifetime mortgage products and payment options.”

Advice is important

Even when a customer thinks they know what they want, advisers still have a crucial role to play.

Find out more about these later life lending myths and the value of advice here