Pepper Money’s research shows that adverse credit is more common than you might think – 15% of a representative sample of adults have experienced adverse credit in the last 3 years. And 16% of this group are planning to buy a property in the next 12 months. When applied to the UK adult population of 52.4 million people, this suggests that there are potentially 1.26 million people who have experienced adverse credit in the last 3 years looking to buy a property.

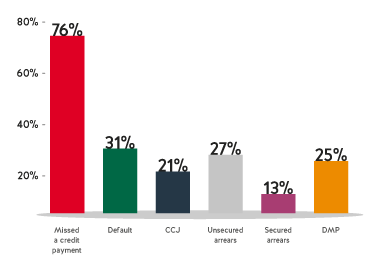

What forms of adverse credit had respondents experienced in the last 3 years?

Adverse credit is most common amongst people who are the prime age to be homebuyers and remortgages. The majority of people who have experienced adverse credit in the last years are aged between 35-44 (43%).

And it’s not just those who are less affluent who pick up adverse credit on their record. 61% of the adults who have experienced adverse credit in the last 3 years and are planning to buy a property in the next 12 months are associated with a higher income.

In fact, Pepper Money’s research shows that regardless of gender, age, or being associated with higher or lower income, anyone can find themselves with adverse credit.

Download the adviser credit study here.