Over the past few years we’ve seen a healthy increase in the proportion of lending we do to self-employed borrowers. This also reflects ONS data which states that self-employment makes up nearly 15% of the UK workforce*.

We understand that when it comes to self-employed applications flexibility is key. That’s why our lending is based on common sense, like looking at net profit rather than dividends, which could help your clients borrow more.

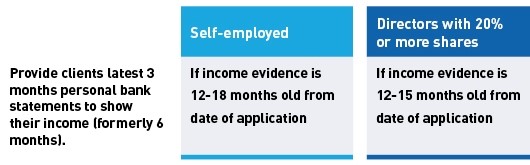

Here are some key points from our policy:

- Directors with 20% or more shares – we take the latest year of the applicant’s share of net profit (after deducting Corporation Tax) and their salary, excluding dividends to calculate annual income

- All applicants must have owned their business or have been trading for a minimum of 2 years

- We need proof of income over a 2 year period, however we will use the latest year’s figures to determine income unless the last two years’ figures vary significantly.

Recent change: