Bridging Finance (regulated) and Property Investor Finance (non-regulated)

To help provide more clarity around the bridging finance we offer, we have separated the regulated and non-regulated finance options in to two individual propositions. To complement this, each has its own suite of documents – links to this new document suite are included below under ‘Documents’.

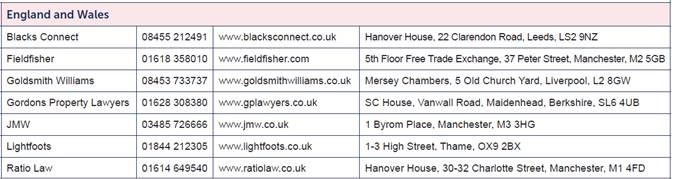

Extended Conveyancer Panel

In response to feedback received from brokers, we have extended our Conveyancer Panel from one to six in England and Wales to provide more choice – the new options available are detailed below and have been updated in our application forms, which are also available via the links in the ‘Documents’ section.

New valuation partner with nationwide coverage

Again, in response to feedback, in November 2015 we appointed Connells as our valuation partner who provide nationwide coverage. To date we have witnessed a significant increase in levels of service and turnaround times, which has been confirmed by brokers that use us for bridging cases today.

Improved validation criteria

We have created a clear breakdown of the documents needed for validation across our bridging finance range, and brokers can rest assured that we will only ask for what our underwriters need. These requirements can be found on page 8 of the Regulated Bridging criteria guide and page 9 on the Property Investor Finance criteria guide.

Document suite

Bridging Finance criteria guide

Bridging Finance product guide

Bridging Finance 0% facility fee product guide

Property Investor criteria guide