November 2022 Roadshows – Register Now!

Hi everyone and welcome to this week’s protection update.

I’ve been a big fan of the various tools we have at our disposal that help us evaluate the quality of protection policies.

The one that immediately springs to mind to me is Compare Quality / Product Features report that you can get free of charge via SolutionBuilder. That’s because it’s right in the middle of our sales process journey.

You produce a quotation and you can, at that moment, evaluate the quality of all the products which return on the quote portal.

Not only does it allow you to find out who offers what; it also scores these services in terms of whether the benefit is free or chargeable. Who can use it – is it just the policyholder or wider members of the family? Who is the service actually provided by? What does it actually cover? And various other considerations.

This week Amanda Wilson sent me a note about a new protection guru research piece which was all about Second Medical Opinions.

And amongst all the different things you get with protection policies; Second Medical Opinion services are one of the best because we’ve used this within our family and the diagnosis and treatment changed after speaking to a different consultant who specializes in this particular area.

In fact, a friend of mine took advantage of a second medical opinion on her protection policy and I don’t think it’s too dramatic to say it actually saved her life. She works within this industry and ill see if I can get her on one of these protection updates to tell her story.

So, let’s take a look at this research piece from Protection Guru…

I’ve added a link to it in this week’s protection update, but let me run through the main highlights for you.

Firstly, its fair to say, and you will know that many providers offer added value benefit services within their protection policies – we’re obviously talking about Second Medical Opinions.

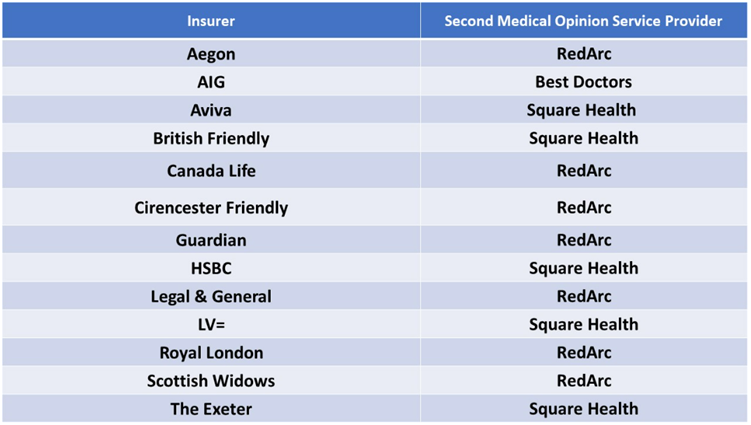

Protection Guru have supplied a full list of the providers that offer Second Medical Opinion services and the associated service providers. I’ve copied that graphic into the transcript.

The next question they asked was who could actually use the Second Medical Opinion service? Obviously, the policyholder could, but who else.

To illustrate this, Protection Guru added another table which breaks this down, by provider, into spouse/partner/civil partner. Only one provider doesn’t offer the Second Medical Opinion which is Guardian.

You’ll also see here that some providers will offer these Second Medical Opinion services to children.

The only provider who does not are Cirencester Friendly. Guardian have a caveat that says children are covered as long as children’s critical illness cover has been included on the main adult policy (either life only or life and CI).

The final analysis on this section is whether the plan holder is covered, IF, that person is different from the life assured.

Only 4 providers will do this which are Aegon, AIG, Royal London and Scottish Widows.

Protection Guru then get into a bit of detail about when the Second Medical Opinion service can actually be used.

There is one provider that only allow you to use the service if you’re in the middle of making a claim. That provider is Canada Life.

But thinking about making claims; if you make a claim and the policy pays out, that could leave you in a position where you lose access to this service?

Well once again, Protection Guru have carried out a piece of analysis which shows the providers who continue to give the policyholder access to second medical opinions after a claim.

The 6 providers who offer this are:

- Aviva,

- Canada Life,

- Guardian,

- Legal & General,

- Scottish Widows

- Royal London

There is a shout out to Royal London who top this list by offering the second medical opinion service for up to 37 months following a claim.

Protection Guru included a section specifically dedicated to Aviva’s Global Treatment service and how this can work in a very beneficial way with their Second Medical Opinion service by not only advising and recommending a course of treatment; but actually, funding it for up to £1 million per year for overseas treatment including travel & accommodation costs.

You might have heard some correspondence from Vicki Churcher who is AIG’s Intermediary Director when they have communicated product updates and news from AIG.

Well Vicky tells her story where she suffered a heart attack back in 2018 and she tells her story in a video which is embedded into this article.

There is another video story which I published recently from British Friendly which again, is definitely worth a look.

All of this just demonstrates the point of which people really need access to this type of cover and also, how you can play a crucial part in making that happen.

Income Protection Champion update

Now this is probably the final income protection champion update before we announce the winner at the NTE on 6th October.

Have you registered?

If not, please do. It will be great to see you there but you need to register. We are nearly full so I’ve added the registration link to this week’s protection update.

Now I’m going to keep you in suspense a little bit by not giving away exactly what everyone has written.

I think this competition has been a real success. British Friendly for example have told me that compared to this time last year; they are seeing around 280% more business written.

Other providers are sharing a similar story and we’ve seen advisers really diversify their recommendations by including income protection with all of our main provider products.

Let me share the top 20 advisers and this is in alphabetical order of first name:

| Aaron Steeples | Laurence Hoffman |

| Andrew Russell | Leanne Bourne |

| Christopher Smith | Megan Meenan |

| Ciara Coyle | Paula Clement |

| Declan McKeever | Philip Lee |

| Gary Gillespie | Ryan Harvey |

| Gary Hobbs | Sam Clark |

| James Groom | Simon Walton |

| Jordan Galloway | Thea Cox |

| Karla Edwards | Wojciech Cieslik |

Thankyou to you and to everyone else who has put a focus on Income Protection.

We’ve now got more advisers recommending Income Protection than we did before and this is making up a bigger percentage of the protection planning we are recommending.

So, it’s just a few weeks until the NTE and we will announce the winner there for both the Income Protection award and also the General Insurance Accident and Sickness award.

Future Protection Development Dates

Now I just wanted to point out some dates for your diaries as we start moving towards the back end of the year…

After the NTE in October, we’ve got a couple of webinars which will focus on ‘Protection Portfolios’. What is a protection portfolio?

The concept is about how you utilize the budget the client can afford to spend and make recommendations which cover the various risk areas the clients have. Everyone has a ceiling to how much they can afford to spend on protection, but there are ways and means to package a solution which makes the best use of that budget.

So those webinars will take place on 18th and 20th October – registration links have been included in this week’s protection update.

And then when we reach November, we’ve got our final set of regional roadshows. We’re coming to the North West, London, Birmingham and South Wales.

The format will be different with round table sessions and also a solid business development piece by myself and Bob Scott. And we’ve got an important slot by Ben Allen our Compliance Director who will give you more detail about how Consumer Duty will be adopted and implemented into the network.

So, it’s a longer agenda, but this new format will be what we use as we start looking forward to next year.

Again, I’ve added links to the roadshow registrations to this week’s protection update.

So that’s it once again from me. Have a great weekend everyone and I’ll see you soon.

soon!