Hi everyone and welcome to this week’s protection update.

In about 3 weeks, it will be IPAW… or Income Protection Awareness Week.

That’s an industry initiative were collaborators from all sides of our industry come together to push and promote the idea of selling more income protection.

Why? Because we don’t sell enough of it. It’s a fraction compared to life cover sales and it’s also significantly less than critical illness sales.

Now I’ve often been asked the question; how do you sell income protection?

I’m not sure I like the framing of that question because it presupposes the outcome when actually, we very often have to have a conversation with our clients to understand where the protection gaps are.

Maybe I’m splitting hairs, but let me give you my ideas about how you get protection on the agenda and how you give yourself the best platform to make it happen and be successful.

We’re the Right Mortgage and Protection Network.

The vast majority of our protection business comes off the back of arranging mortgages. That’s the most common situation for protection across our whole industry so I’m going to use that as the example.

When you introduce yourself to a new client (let’s say they have got in contact because they want you to arrange their mortgage); it’s really important how you set up the way things are going to happen.

Yes, the client has come to you for a mortgage, but you need to explain your duty of care for clients who take proper financial advice from you.

So, you can confirm that you’ve come to the right place. We will start our conversations today by getting to know you and understand what’s important to you. This is a crucial stage in the sales process because that insight will help you locate the most suitable and affordable mortgage for you.

That will help you buy your home.

But also…

It’s my duty of care to make sure you don’t lose your home.

That means there are various risks which could stop you from being able to maintain your mortgage payments and therefore we need to have a conversation about what those are. Is that, ok?

Obviously when people are buying their home. Let’s say their first home. They’ve got a lot on their mind and maybe; the insurances aren’t high on their priority list.

But who’s leading this conversation? It can’t be them because they have come to you for advice. It has to be you.

And you can say this is how we do things here. This is what a professional service looks like.

It’s to help you buy your home but it’s also to make sure you don’t lose it, should the worst happen.

Is that ok?

If they are a reasonable human being, they will say yes that is ok.

And you’ve set a marker down for how things are going to happen. You’ve got protection on the agenda early and this can now be parked whilst you get into the business of arranging the mortgage.

But when you produce your first mortgage illustration, you can point out that statement which appears on all of these mortgage illustrations.

It’s written by the regulator for financial services, the FCA.

And it says “your home is at risk if you do not keep up repayments on your mortgage or other loan secured on it.”

What does that mean?

It means you could lose your home. It could be repossessed if you cannot keep up those regular payments?

This is important and that’s why it’s written on every mortgage illustration and on your mortgage offer.

And that’s why (when I mentioned this to you earlier) we have to have a conversation about what those risks are.

This goes back to my professional duty of care for you and your family.

We have a set of principles we have to work to and principle 10 specifically refers to this. It says “A firm must arrange adequate protection for clients’ assets when it is responsible for them.”

It’s good to plant seeds and remind the customer about the process and what’s going to happen.

If you think about what I’ve just briefly outlined there; who wouldn’t be impressed by that? A professional who is assertively expressing their duty of care for the client. I think that sounds good.

If you think about healthcare; doctors, consultants, nurses have a duty of care too for their patients. Sometimes they tell them things they don’t necessarily want to hear but it’s for their own good. ‘Tough love’ you might call it?

What we do is very similar, but we have to have a process where we get the protection conversation on the agenda. If we leave it too late, it comes as a surprise, out of the blue and if the mortgage has already been arranged; the client got what they came for and you’ve got a tough task to make protection a priority.

Now when you get to the protection conversation, how do you start it?

Think about the language you use? What do you say?

Is it simple and understandable for your clients to understand?

We need to take them on a journey where they can make some informed decisions about what their priorities are.

OK, we’ve got the mortgage sorted and that’s the key thing which is going to help you buy your home.

Now we need to talk about the risks to you keeping your home over the long term.

The risk statement says “your home is at risk if you do not keep up repayments on a mortgage or other loan secured on it.”

Tell me… what could stop you from keeping up your mortgage repayments?

Now at this point. Don’t say anything. Let them think about it and let them answer the question?

“what could stop you from keeping up your mortgage repayments”?

Will they be able to answer that question?

Yes, but they might need to think about it for a second. They might never have thought about that before now.

Let’s say they say “I could be made redundant”. Yes, that’s one thing. Would you back yourself to get another job?

Ok, what else?

They say “I could go off work sick”? Yes, that’s another thing which could happen.

What’s the worst thing which could stop you from keeping up your mortgage repayments?

“I could die”. Yes, that’s the worst things.

These are all things which could stop you from paying your mortgage each and every month.

Now the thing is; because we have decades and decades of experience of this market and customers just like you; we can actually illustrate the chances, for you personally, of these risks you’ve outlined.

Now, at this stage I would suggest you use a simple risk probability tool. My favorite is the LV= risk calculator. It was the first one and it’s the simplest to use. In fact, you could ask the client to enter their details onto it themselves.

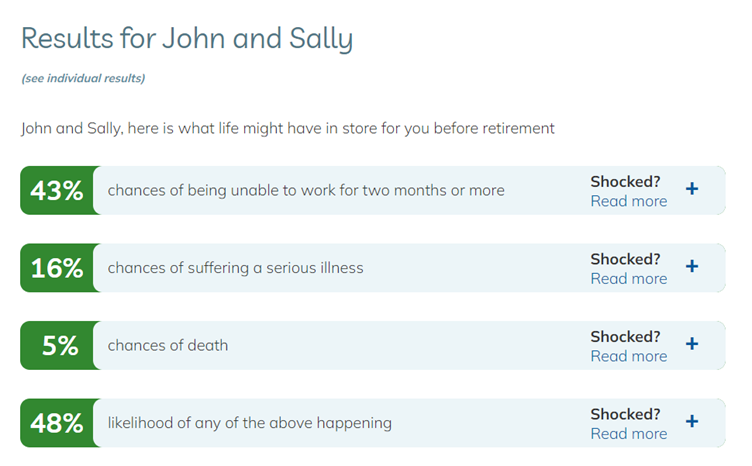

In this example, my clients are 29 and 30 and they are taking a mortgage for 30 years. They are male and female and they don’t smoke.

They might never have had this conversation with anyone before so they need you to guide them.

If you look at the risk reality report, you can see the results which give you a platform to help the client understand their priorities:

You said the worst thing which could happen is you could die. The good news is that’s quite a low risk. Your both young and you don’t smoke. That means there is a 5% chance that one of you will die during your mortgage term.

You said you could go off work sick?

Well, there are a variety of things which stop people from working.

The chance of you suffering a serious illness (we’re talking about Cancer, Heart Attacks, Strokes – that type of thing); that’s a higher risk at 16% – for a couple just like you.

And the biggest individual risk area is the risk of just being unable to work for 2 months or more. That’s for any type of sickness or accident that keeps you off work.

That’s a 43% chance for a couple like you – that’s nearly a 1 in 2 chance.

And the biggest risk of all – is any of these 3 things happening during the term of your mortgage which is 48%.

How do you feel about this?

What is your number 1 priority that you would like to address first?

What’s your next priority?

So, going back to that original question “how do you sell income protection?

That’s how you sell it.

Signpost protection from the very beginning. Be confident and be assertive.

You’re steering this ship. It has to be you. You’re the professional. It can’t be them leading the conversation.

Put it into the context of all the protection risk areas. Use a process that helps the clients work out what their priorities are.

Use the risk statement – your home is at risk if you cannot keep up your mortgage repayments.

That’s a great link to setting up a protection conversation every time.

The regulator mandated a statement like that to appear on every mortgage illustration.

And it goes back to principle 10 which is “A firm must arrange adequate protection for clients’ assets when it is responsible for them.”

And with consumer duty being implemented across our industry, we now have principle 12 to consider which says “firms to act to deliver good outcomes for retail customers”

That means having a conversation with them. Put them in an informed position.

Give them the opportunity to tell you they don’t want it!

Let’s talk about Protection – Online – Thursday 8th September 10am to 12noon

Next week on Thursday 8th September we will be running another ‘Let’s talk about Protection” and this time we’re looking at ‘Tools to get the job done’.

There won’t be any providers. It’s just you and me and we’re going to have a discussion about ideas to help us improve our effectiveness. We ran one of these sessions earlier in the year and I think it worked so well because you get to hear from lots of other advisers around the country and you’ll definitely come away with some ideas and some alternative points of view.

I’ve added the registration link to this week’s protection update, so if you haven’t already registered – click on the button and register now and I’ll see you next Thursday.

But we also have another event next week…

It’s the rescheduled London roadshow. This is going to be held at HSBC’s offices at Canary Wharf. It’s a superb venue and I tried out the Elizabeth line the other day and it really does cut down the travel time. You can get from central London across to Canary Wharf in just a few minutes.

The registration for this is now closed, but if you are registered; remember to bring photo id with you to the building.

Just tell the security that you are attending the Right Mortgage Roadshow and someone will come down to collect you.

It’s going to be a good protection only event and I look forward to seeing you there.

And finally…

Income Protection Champion update

We are in the final stages of our Income Protection Champion competition. We’re now in September and this competition ends at the end of this month.

I can tell you it’s really tight up at the top and I would say there are several of you in real contention of winning this.

Let me run through who are currently our top 15 advisers as at 31st August when I’m recording this protection update.

In alphabetical order…

| Andrew Russell |

| Ciara Coyle |

| Declan McKeever |

| Gary Gillespie |

| Gary Hobbs |

| James Groom |

| Jordan Galloway |

| Karla Edwards |

| Laurence Hoffman |

| Leanne Bourne |

| Matthew Whitehead |

| Megan Meenan |

| Philip Lee |

| Thea Cox |

| Wojciech Cieslik |

You all in contention of winning this competition and I can tell you there is currently a tie at the top of the leaderboard. There are few a few weeks left and we will announce the winner at the NTE next month.

Now we’ve added something into this competition to help us identify our winner in a similar way to goals difference in football. That’s the diversity of provider you use.

So, let’s say we have 2 advisers who are tied on 30 income protection sales each. The winner will be the one who has used the most life offices to place this business.

- So, if adviser A writes 30 policies and uses 7 life offices – that’s 37 points.

- If adviser B also writes 30 policies and uses 8 life offices – that’s 38 points and adviser B would be crowned the winner.

So that’s it from me for another protection update.

I look forward to seeing you at the Roadshow in London on Tuesday and also the ‘Lets talk about Protection’ online session next Thursday.

Bye for now.