Hi everyone and welcome to this weeks protection update.

We’ve released the dates and locations for our kick off roadshows in January and these will start on 11th January in the Midlands. We’re going to London, Manchester, North East and South Wales.

The format of these roadshows is the most ambitious yet and we’ve got a great line up for you including an expanded exhibition zone. If you’re interested in looking at Group Risk Protection Business; we’ve got Unum in attendance and lots more.

The theme of our Quarter 1 program is “Make more money in 2023, not less during challenging times”

So, we’ve briefed all the providers and exhibitors to work to that theme. We’re talking about sales ideas, angles, opportunities, reasons to get in touch with customers, reasons to review what they already have.

There are so many advice opportunities and we need to get on the front foot with a bold and ambitious plan.

Now I need to explain how our development program is going to run next year.

2022 has been a year where we’ve learned a lot in this post pandemic world.

Back in January 2022, we had roadshows lined up but we couldn’t run them because we weren’t quite out of the woods with covid and you’ll remember we had to deliver those online (after running actual live roadshow just a few months before in October 2021).

The feedback we’ve received from you is that:

- Online works. Not all the time, but we’ve proved that zoom is a very convenient way of meeting up and staying in touch.

- You want more balance to the roadshows. Yes you want to hear from providers, but also from the network and also from other advisers.

- Perhaps we ran too many face to face roadshows last year?

So, in January, we’re running 5x live face to face roadshows across the UK.

Then we only have 6 remaining roadshows which will take place across the rest of 2023 – that means 11 in total.

We’re doing 2 in April, 2 in June and 2 in November.

To compliment those, I will be running monthly online ‘Sales Focus’ online sessions. These will take place on the first Monday of every new month starting in February.

These will be focused towards driving up sale across all propositions and you’ll get to hear from The Right Mortgage, from advisers across the network and from guest speakers. It’s an exciting and ambitious plan for 2023 and I would really like you to get behind it.

That’s a heads up, but you’ll get more details very shortly about all our development activities for 2023.

Urgent reasons to get in touch with clients

Now this week’s protection update is called Urgent reasons to get in touch with clients.

Why urgent? Well, we need to create urgency. If it is not urgent, its less important and clients will find reasons to fob you off and turn their attention to their own priorities.

Can we safely say ‘urgent’ though?

Well, if you have a client who let’s say doesn’t have any income protection; is that an urgent reason to get in touch?

I’d say its urgent. If they find themselves in a position where they can’t work due to sickness or accident and they lose their income; that’s a financial disaster.

What about if a client has moved home but not updated their life policy? Do they have enough cover? Do they have any cover? Do they have enough Critical Illness Cover? If the policy is decreasing; has the policy been adjusted or a new policy taken out to match the terms of the new mortgage?

If they have a life policy, is it in trust? If it is, does it need a review? Are the intentions still the same as they were at the time they took out the policy? Does any of it need updating?

What about clients who have indexation on their policies? Are they worth giving a call? The vast majority of indexation is set at RPI (retail prices index) and with high inflation; their premium and cover will increase substantially. Now the provider will organize that, but perhaps it’s an urgent reason to give your client a call and explain what’s going to happen, remind them why this was included and discuss their options if they have any concerns?

One of the things I’ve really enjoyed about my career is listening and watching what different businesses do. Everyone is different and we all have our own opinions and preferences to what we think is the right way of doing things.

But we can learn from what other advisers do – both the good and the bad.

Sometimes it is just small adjustments to our sales process which can make a big difference.

Protection Objectives

If you look across the industry, it’s true to say that mortgages are the most common reason why someone takes out a protection policy.

But we also know that having a mortgage is not the only reason why you should have some protection.

We need to make this very clear to clients at the very start of our dealings with them.

Explain that as a protection adviser; you help clients achieve 2 objectives.

That is to make sure you:

- Don’t lose your home

- Maintain your lifestyle

That’s it.

Those are things that we can take an educated guess our clients do want.

So when arranging a mortgage, you’re putting into place one of the biggest debts your customer will ever have and there is a string attached…

It’s secured.

It’s secured against the property which means the lender can take back the property and sell it to get their money back, if there is a problem in the future.

The problem…?

That means not keeping up the repayments on the mortgage each and every month.

So the first of our objectives is to make sure you Don’t lose your home

We can’t stop bad things from happening but we can put money on the table when your clients need it the most. And that means when they die or when they get sick…

Now you don’t need me to tell you that your clients will pretty much always have a ceiling to how much they can afford to spend on protection insurance. That’s just the way it is.

But, we know things will change. Circumstances will change. They will change jobs, they will get pay rises. They will move homes and the shape of their family will change from when they do not have children, to have children, to children grow up and leave home.

The protection plan!

So let’s say you have some new clients who want to buy a property and they need you to arrange the mortgage.

You’re going to set your stall out and explain what’s going to happen when it comes to protection.

You explain “My role as a professional and responsible adviser is to source you the most suitable mortgage on the most competitive terms”

“but it’s also to make sure you don’t lose it should the worst happen”

“is that ok?”

We are not talking about protection or insurance. We’re talking about the high-level objective of not losing the home.

That should sound ok to the client and they should agree to that because it is perfectly reasonable.

“That’s the first key objective I want to help you with. Keep your home.”

“The next objective is to make sure that you and your family can maintain your lifestyle.”

“That means live the life you want to live without financial burden, whatever happens in the future”

“Again, does that sound ok?”

“This means I will keep in touch from time to time to work to these objectives. I call it the Protection Plan”

Now let’s say you have a couple of clients called Richard and Jenny. You’ve arranged the mortgage and you’ve set up some joint life or earlier Critical Illness Cover for the them. They now have some decent level of protection cover. But is that the end of it?

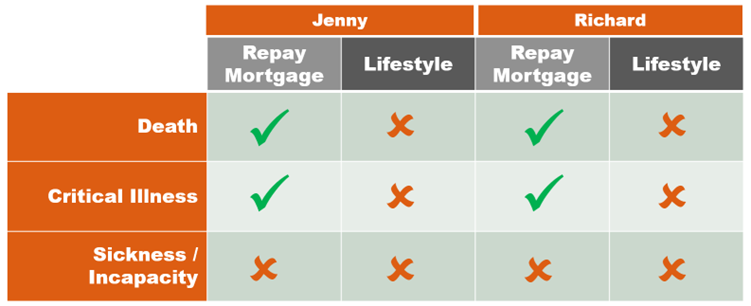

I’ve created this simple chart to illustrate where they currently stand:

You can see that we’ve covered the ‘repay mortgage’ objective for death and critical illness for both clients.

But, there are still lots of other areas completely unaddressed.

Is that an urgent reason to call back in a year or 18 months?

If the client understands we are not finished yet and there is more to do; it’s not a cold call when you make it.

Very often we tackle the ‘mortgage’ objective, there are in fact there are lots of other need areas.

If we factor this into our sales process by explaining that we are going to work with our client over the long term. This is a project that needs maintenance from time to time; we can normalize this process in the eyes of the client and get agreement that this is how we work.

I think that sounds professional and if the client agrees that they are happy for you to work with them; you can book them into your diary to have those catchup conversations.

Now mortgages are always a great time to review things because a changing rate on the mortgage is an urgent reason to call.

But think about all the other things which are also legitimate reasons to keep in touch with your clients…

Its worth thinking about these so you can illustrate the power of using a professional adviser such as yourself with examples of what you might need to consider in the future.

Here’s a few from me:

- Getting married – does that change the cover they may need? Can they utilize a GIO to increase cover in a simple and easy way?

- Having a baby – what cover is available for children and can you help add this onto their policy?

- New products on the market – we know that the protection market is constantly evolving and its definitely worth reviewing the cover that clients have. Maybe you can improve this for them?

- Changing Cover – is this needed? What if the cover isn’t fit for purpose anymore? For example, the deferred period on an income protection plan if they change jobs?

- Talking about changing jobs – what benefits are they losing and what do they get from their new employer? What if they are going self-employed?

- I mentioned trusts Are these set up correctly and is everything up to date? Does anything need to be amended? What about the beneficiaries? Are all the trustees still available?

- And of course, those unaddressed need areas? Can we now look at it this time where perhaps previously, this was out of reach.

Everything I’ve mentioned today are simple process changes that you can make.

The theme of our first quarter next year is to make 2023 better than 2022. That means you earning more money next year than you did this year all by giving proper advice to your customers.

The market will always have its ups and downs but protection is a constant. Our clients need it, but they also need you to help them get it.

Have a great weekend everyone and I’ll see you soon!