Hi everyone and welcome to this week’s protection update.

It was good to see you if you were down at the London protection roadshow – this was the roadshow we had to postpone in June due to the train strikes.

It was a good day with a variety of different presentations which all ultimately led back to the idea of giving professional advice, covering all the bases, identifying key things which make the recommendation more personal.

And at the time of recording this podcast; I’d also like to thank you if you joined me at ‘Let’s talk about Protection’ yesterday. That’s a bit weird saying that because I’m recording this on Wednesday, the day before Let’s talk about protection, and this protection update goes out on a Friday??? Anyway… good to see you!

Now I mentioned the work of the PDG this week at the London roadshow. The Right Mortgage & Protection Network are members of the PDG and we do have a seat at their table…

Who are the PDG?

PDG stands for the Protection Distributors Group. The PDG is a group of distributors from across the industry with one main goal in mind which is to help people find the protection they need by encouraging insurers and intermediaries to deliver better consumer outcomes

What does that mean?

Well sometimes it means lobbying the industry and providers to find better solutions to real problems clients face.

Let me read the PDG vision & mission statements:

Our Vision

The Protection Distributors Group (PDG) want to build trust within the insurance industry. We see a future where empathy, honesty and transparency are the core drivers to insurer and intermediary care.

And the mission statement:

Our Mission

Helping people find the protection they need by encouraging insurers and intermediaries to deliver better consumer outcomes.

So, the whole aim is to work to create better outcomes for consumers. We’re obviously talking about this in relation to protection so let me show you 2x key pledges that providers signed up to when it comes to paying claims.

The first one is the Claims Charter.

Bear in mind, not all providers signed up to this. The idea is that the Claims Charter creates a minimum basic standard of care about how claimants and their families are treated during the claim process.

I’m going to read the text for the Claims Charter and then break it down in terms of what the providers signed up to.

Purpose of the PDG Claims Charter

The PDG is keen to ensure claimants have the best support; a caring, efficient and hassle-free experience with claims paid as quickly as possible. We’ve put together this Claims Charter to outline what we feel should be standard best practice based on our experiences helping our clients with their claims.

We are not looking to attribute ratings or scores to insurers as found elsewhere – it’s simply a case of whether firms meet the Claims Charter requirements and if so, we’ll be delighted to give your firm our stamp of approval and promote this to the market.

There are many fantastic approaches provided by insurers at claim stage to help claimants and we considered adding much more into the charter to reflect some of the outstanding work being done. We felt it was unrealistic though to expect every insurer to offer the best of everything available across the market, and we wanted to ensure our requirements were achievable. This Charter therefore simply aims to secure a minimum level of support to claimants by all insurers whilst expecting most firms to also go above and beyond.

We will routinely review the Charter though in our continued efforts to nudge our industry forwards for the benefit of consumers.

Now those reviews have been taking place recently and will continue to do so. There are quite a few advisers as members of the PDG but let me know your thoughts about your experiences when your clients have been making claims. I know not all of them have been good because I’ve spoken to several of you about specific cases.

In the protection update, I’ve added a table which shows which providers have signed up to the ‘Claims Charter’ by way of those that you have access to. This table also shows the ‘Funeral Payment Pledge’ which I’ll come onto in a minute.

Let’s take a look at what this ‘Claims Charter’ is…

If you look at the table in the protection update and if there is a tick in the box against the ‘Claims Charter’; this means those providers have signed up to the following and pledge that this will be the minimum standard:

PDG Claims Charter

- Dedicated Claims Team available, with a phone-based claims process for claimants to submit and manage their claim throughout, supported by digital documentation to assess claim efficiently. Paperwork only used where there are no digital alternatives possible or where claimant requests.

- No potential claimant can be turned away by anyone not on the Claims Team.

- Claimants to have named point of contact, with regular updates to claimants at least every two weeks, unless otherwise agreed, to keep them informed of progress. Queries from claimants during the claims process to be responded to by end of next working day.

- Intermediaries are notified of all claims when made, to include the product being claimed on, without the customer being asked to opt in. Opt out options should be avoided whenever possible, but if the customer explicitly asks for their intermediary not be informed then their wish must be adhered to.

This will ensure records can be updated and no potential distress caused to clients and families through the intermediary not knowing about a claim. - Pro-actively offers the PDG Funeral Payment Pledge and/or advances payments to speed up life cover claims where there is no trust in place, or where other factors could delay payment being made.

- Once a claim is approved, money is to be paid to the claimant within 72 hours (ignoring external factors out of insurer control such as probate), excluding income protection claims which should be paid at the earliest available payment date.

So again, let me know your experiences…

Let’s take a quick look at the ‘Funeral Pledge’ which says:

PDG Funeral Payment Pledge

Paying a claim is the moment of truth for insurance companies. Of course, we know that many claims are paid quickly, but some are still held up by probate leaving families waiting months or even years for the money.

To ensure that families can pay the funeral costs, we have asked insurers to offer to advance some funds directly to the funeral director where no other arrangements have been made. An advance of this nature could make a real difference.

Some insurers already did this but on a case by case basis, but we ask as part of the pledge that this is done pro actively on each delayed claim.

And there are just 3 things the PDG ask insurers to pledge to which are:

- To advance a minimum of £5,000 to a funeral director when they otherwise can’t pay the claim due to probate delays, etc.

- To pro-actively offer this in every case where there is a delay.

- To pay the funeral director after you’ve fully assessed and accepted the claim to ensure that there was no non-disclosure.

Let me know what you think and if you’ve got any opinions on either of these pledges based on claims that your clients have made.

An interesting piece of Income Protection positioning?

Now finally, I just want to conclude with an interesting bit of positioning regarding Income Protection.

There was a comment on the London roadshow this week which I think is a valid point about why people sometimes prefer a Critical Illness policy over an Income Protection policy.

This was to say that the sums assured from CIC policies can appear to be life changing and therefore more attractive than a basic replacement income, which is a much more modest sum.

There is a question there about who exactly finds the CIC policy more attractive – is it you the adviser, or the client, or both of you?

I’ve written an article on this and you’ll see it in the network magazine which publishes shortly.

But, here’s what I think is an interesting bit of positioning with regards to the reality of people who make claims on policies.

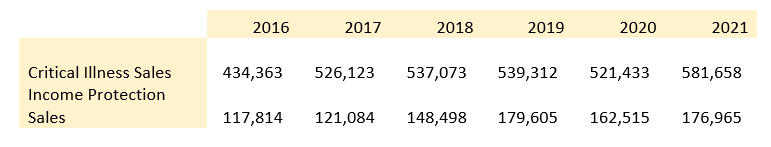

If you look at that past 6 years – I’ve gone back to 2016… you can see that the number of policies which include critical illness cover are consistently much higher than income protection new sales.

I’ve added a table to show this within the transcript of this week’s protection update. The critical illness policies are either standalone CIC policies, or accelerated policies. The income protection sales are any type of individual income protection policy.

We’re typically talking about an average of more than 500,000 critical illness policies sold each year and around 150,000 income protection policies sold each year.

Is it fair to say that based on these numbers; it’s likely that more people will have a Critical Illness policy than an Income Protection policy?

Looking at the last 6 years its 3,139,962 CIC policies sold in total compared to 900,000 Income Protection policies sold?

Well did you know… if you look at the total number of claims made by people with protection policies last year, as reported by the Association of British Insurers; in 2021:

- 18,016 critical illness claims were made last year

- 27,892 NEW income protection claims were made last year. That number doesn’t include claims which started before 2021 so the total number of people claiming on their income protection policy last year will be higher.

I thought that was an interesting bit of framing.

And it’s not to say anything about the value of Critical Illness Cover – it’s crucial and vital for people to have.

But Income Protection does a different job and really; it’s better to have some of both types of covers.

I’ll give you another update about our Income Protection Champion competition next week. In the meantime, have a great weekend and I’ll see you soon!