From Thursday 30 April to support you and your clients during this challenging time, and to help reduce your time to offer, we’ll now be asking you to confirm via a Mortgage Application Tracking System (MATS) message on all new residential and Buy to Let applications whether or not your client’s income has been affected by coronavirus (Covid-19).

This new request will be displayed once you’ve submitted the full mortgage application alongside any other income evidence requirements and applies to both employed and self-employed applicants. You’ll need to provide us with full details, plus any supporting documentation.

Capturing your client’s income

The income keyed in the affordability calculator and the Agreement in Principle (AIP) must reflect your client’s current income e.g. if they’ve been furloughed, then the furloughed income should be entered. You’ll also need to add a note to the ‘General notes’ field within the full mortgage application to confirm your client’s full salary.

Employed applicants

We’ll send you the below new MATS message:

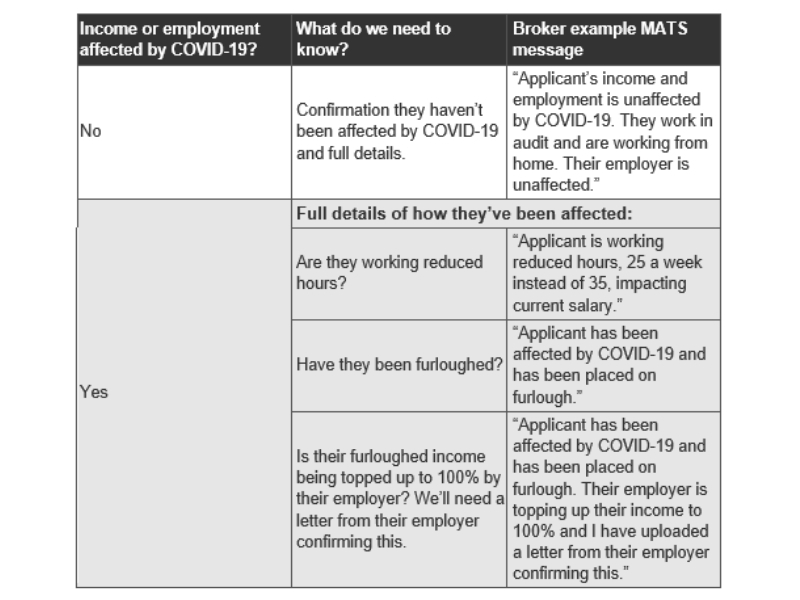

Has the applicant’s income or employment been impacted by Covid-19?

Please send us a MATS message confirming whether or not they have been affected. Where they have been affected, please give us full details if they’ve reduced working hours or have been furloughed. Where they’ve been furloughed but their income is being topped up by their employer, please also upload a letter from their employer confirming this

Self-employed applicants

We’ll send you the below new MATS message:

Has the applicant’s self-employed business been impacted by Covid-19?

Please send us a MATS message confirming whether or not they have been affected. Where they have been affected, please give us full details of any change in income and whether they have applied for Government Assistance.

Further information

If you are made aware of any material change to your client’s circumstances, please send us a MATS message to let us know.

Thank you for your continued support.