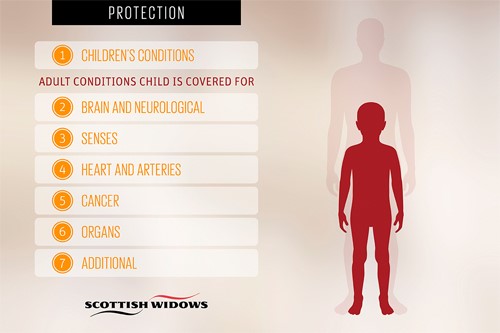

As you’re aware, protection can provide cover not just for your clients, but for their children too. I wanted to share with you how we group the conditions we cover into categories, to make it easier for your clients to understand how they can provide cover not just for themselves, but for their whole family.

All Scottish Widows Protect critical illness cover plans automatically include children’s cover.

| • | In a similar way to how we group the conditions we cover for someone who takes out a policy, children are covered for all our main and additional critical illness conditions (apart from total permanent disability), as well as for specific children’s conditions. |

| • | Children are covered up to their 22nd birthday and cover is provided for up to a maximum of £30,000 for critical illness cover (from birth) and £10,000 for life cover (from 30 days old). |

| • | Children’s Cover provides cover for your clients’ natural or legally adopted children, step children or any child they are the legal guardian for – the child doesn’t need to be financially dependent on the policy owner. |

You can find out more about our Children’s Cover, and the conditions that are covered, in our interactive pdf.

If you have any queries or would like to discuss this further, please get in touch.