Paragon’s latest PRS Trends Report

I was sent an interesting bit of communication this month, and thought I would hand my introduction straight to Paragon:

A year marred by economic and political instability; it is difficult to deny that 2023 was a challenging year for businesses across all sectors.

This report, covering the second quarter of 2024, picks up where the last left off, providing further evidence of private rented sector landlords having weathered the storm and facing the future with a growing sense of optimism.

Analysis of in-depth interviews with almost 800 landlords reveals:

- Average rental yields achieved by landlords have hit a 10-year high of 6.3%

- More than eight in 10 landlords report strong demand, a market characteristic evident since the pandemic

- During the quarter 85% of landlords reported generating a profit from their lettings businesses

- Falling by one percentage point since Q1, the incidence of arrears continues to broadly track downwards, decreasing by around 30% over five years

Louisa Sedgwick, Paragon Bank Managing Director of Mortgages, said: “I’m pleased to see that our second PRS Trends report of the year picks up the positive momentum of the first and highlights a number of things to be optimistic about.

“Yields that landlords report achieving have hit their highest in a decade and this is helping to sustain profitability. A likely contributor to strong yields is tenant demand, something that is elevated, continuing a trend we’ve seen for a number of years now. The research also shows a slight drop in arrears recorded by landlords, with renters now around 30% less likely to fall behind on their rent compared to five years ago, which is obviously really encouraging.

“All of this is helping landlords to feel more optimistic, and we see an improvement in confidence levels compared to the same time a year ago. Economic stability and regulatory certainty would help to boost this, giving landlords the confidence to invest in providing more and better quality homes for renters.”

Read the full report – here

And did you know?…..We are on Spotify!

Listen to our latest Podcasts from all areas from Lending, Protection and to Later life lending. These podcasts are free and available to you while you work and travel so click on the link and follow us for more updates!

Latest News

Get in touch

Anita White

Head of Lender Relationships

Celebrating our advisers

With Equity Release within The Network, we pride ourselves on being Lifetime Mortgage Specialist’s. Our advisers really do provide a holistic service where they are there for the customer for life and think way past just another fix term.

We have awarded these advisers who give full product offering to our older borrowers by highlighting them with a ‘Later Life Lending Accredited Adviser’ status, to shine a light on their support to customers. These advisers can review the whole of the market and other associated products in order to provide their customers with a full service. We are excited to celebrate their achievements with a launch dinner in October.

For those advisers who want to find out more on how to become accredited get in touch with the team.

And did you know?…..We are on Spotify!

Latest News

Get in touch

Victoria Clark

Head of Equity Release

Income Protection Task Force: expert analysis and news

Well done to everyone that is recognising that income protection is vital for your clients. The right mortgage stats show that income protection is now 30% of our protection sales up from 12% last year. Income protection is the most important protection product, without your income how do you pay for your lifestyle?

Tom Fish has researched the market and discovered the average income protection claim is 5 and half years! If you want some creative IP sales tips call Phil Davies and utilise his knowledge.

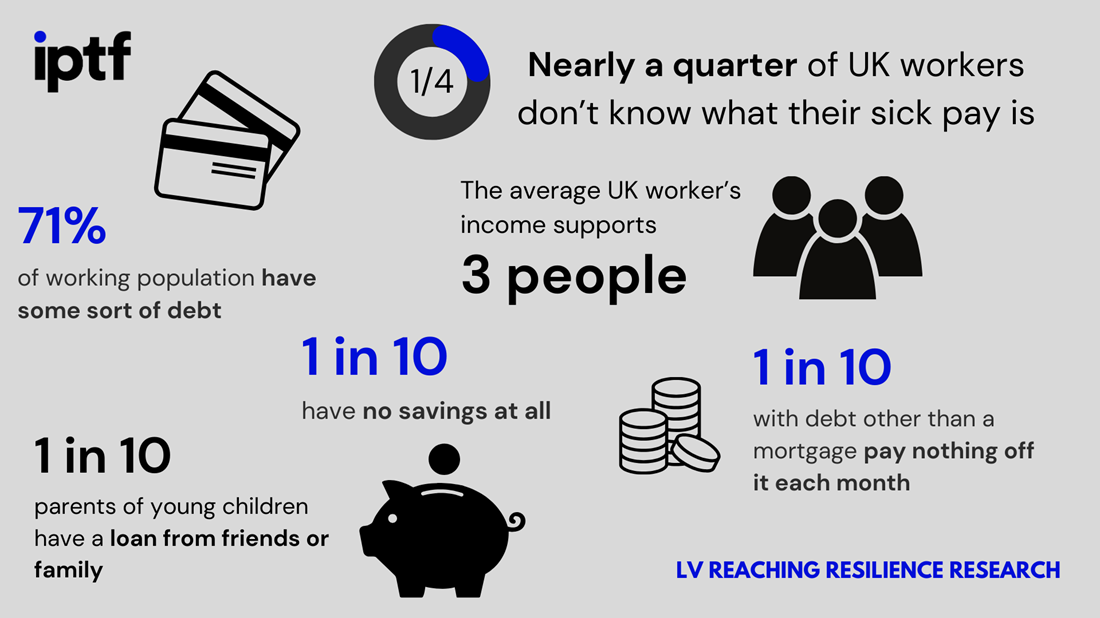

Interesting update from the Income Protection Task Force using the LV= Reaching resilience research materials. Worth a read if you are interested in diving further into Protection statistics!

Latest News

Get in touch

Amanda Wilson

Company Director

Catching you up on the latest

A few months ago, Bipin caught up with one of our advisers to talk about what it means to go self-employed. We know that isn’t the easy route by any means and appreciate that a lot of you are in the boat. The buck stops with you which is why we try to do our best as a Network to support you and make sure you never feel alone.

We used the session to create our first podcast episode for PMI.

Join us on Spotify!

Listen to our latest Podcasts from all product areas. These podcasts are free and available to you while you work and travel so click on the link and follow us for more updates!

Coffee Mornings:

Join us for the September coffee morning, recorded on 18th September 2024 where we are joined by Tracy Williams from Westfield. Take a look at their products and how you would pitch them to your clients. Bupa then come along to talk about their adviser support, so thanks to Charlotte Kirko and Melissa Richards for that.

If you missed it we have links to our recorded sessions which will earn you CPD time:

PMI Coffee Morning September Catch up.

Shout out!

A massive congratulations to Simon Worden and Jamie Spencer who both achieved CAS for PMI. We all know how much work that involves so well done both!

Key Links:

Dedicated section for PMI advisers

PMI Adviser only Forum Hit ‘subscribe’ in the top right hand corner to keep up with all our latest topics.

Latest News

Get in touch

Bipin Sandhu

PMI Supervision & Development Manager

Adviser survey report from Paymentshield

Really interesting read from Paymentshield which talks about the significant shift in the importance of General Insurance. With evidence taken from their 2024 Adviser Survey, hear what they have to say:

Paymentshield releases the results of the 2024 Adviser Survey in new report

Paymentshield has published its 2024 Adviser Survey, revealing a significant shift in the importance of General Insurance.

For the first time, less than half of advisers report missing opportunities to discuss GI with clients—a 12% improvement from four years ago. This shift is potentially driven in part by the introduction of Consumer Duty, with 94% of advisers now recognising GI discussions as a vital part of fulfilling their responsibilities to clients.

The landscape of General Insurance (GI) is evolving, and with it comes both challenges and opportunities for advisers. Price sensitivity remains a significant hurdle, with 90% of advisers noting that clients are more price-conscious than ever. This increase in price awareness has led some advisers to shy away from GI discussions, fearing they can’t compete with comparison sites.

However, the report’s data shows that over a third of advisers have seen GI become a more important source of income in the past 12 months. Clients, too, are increasingly seeking advice on GI, with over half more likely to request it than in previous years. This growth in demand highlights the evolving role of GI from a secondary offering to a central pillar of comprehensive financial advice.

To find out more and read the results, download Paymentshield’s Adviser Report here.

Latest News

Get in touch

Amy Wilson

Head of General Insurance (PMI and GI)