As you’ll be aware the restrictions impacting the ability to conduct physical property assessment has prompted a greater reliance on AVMs and remote (desktop) valuations across the market. Even before the challenges presented by the Covid-19 restrictions, we already supported a significant proportion of your client applications with an AVM for qualifying Residential mortgage and Buy to Let remortgage applications.

In addition, we have since introduced remote valuations for new and existing pipeline applications, so we can continue to support many of your clients with their mortgage needs at this potentially difficult time, despite not being in a position to value their current or prospective property in person.

Many mortgage requests will benefit from an AVM and it will be evident within our application system whether your client’s property has received a successful automated assessment. For those where an AVM isn’t supported and a remote valuation is required, we ask that you check eligibility, and only proceed to submit an application if this criteria is met.

Which homes could be eligible for a remote valuation?

Remote valuations are potentially available for all Residential and Buy to Let application types, subject to meeting BOTH the maximum loan to value AND the maximum property value criteria, as well as the other exclusions listed below:

London (properties inside the M25)

- Residential maximum 80% LTV: Properties up to £2m

- Residential maximum 50% LTV: Properties between £2m – £3m

- Buy to Let maximum 75% LTV: Properties up to £750k

Rest of the UK

- Residential maximum 80% LTV: Properties up to £750k

- Residential maximum 75% LTV: Properties between £750k – £1.5m

- Buy to Let maximum 75% LTV: Properties up to £500k

Exclusions:

- Properties in Northern Ireland

- Properties with more than one acre of land

- Properties built before 1850

- Listed Properties

- Owner occupied properties worth more than £3m inside the M25 and £1.5m everywhere else

- Rental properties worth more than £750k inside the M25 and £500k everywhere else

.

Important: Please be aware that meeting the above criteria doesn’t assure that a valuation for lending purposes is guaranteed via remote valuation and meeting ALL criteria is a pre-requisite for a property to be considered for remote assessment.

Submitting new applications

If a new application is received where the AVM has been unsuccessful and the request also falls outside our published remote valuation criteria, we’ll remove the application from processing and notify you of the same. Therefore, please ensure you check the AVM status and remote valuation eligibility (where AVM has been unsuccessful) prior to submitting your clients application.

Existing received applications

Where an existing received application is reliant on a remote valuation, but either doesn’t meet the eligibility criteria or has been unsuccessful in attaining a remote value for lending purposes, we will be in contact with yourself shortly to advise of next steps and options available. Applications without a confirmed value for lending won’t be assessed until you have confirmed your clients’ preferred way forward.

Please read our full customer FAQs

Thanks for your ongoing support

Please be advised we are making changes across our Residential, Buy to Let and Reward ranges effective Thursday 7th May, 2020.

Updated Valuations Policy

On Friday, we confirmed that in addition to continuing to support a significant proportion of Residential and Buy to Let applications with an AVM, we have also introduced remote valuations for new and existing pipeline applications, so we can continue to support many of your clients with their mortgage needs at this potentially difficult time, despite not being in a position to value their current or prospective property in person. Remote assessments are available for qualifying Residential properties valued up to £3m, and BTL properties up to £750k. Please click here to read the full details.

Key Product changes

Following these valuation changes, and our recent re-instatement of 80% LTV Residential purchase and remortgage products we are now pleased to confirm the re-introduction of:

- Competitive new 75% LTV Buy to Let remortgage products

- A selection of Help to Buy rates, including products to support Help to Buy London & Help to Buy Scotland applications

- New 80% LTV Product Transfer and Further Advance products within our Residential Reward range for existing Barclays mortgage customers

IMPORTANT: From today, new and existing products within our Residential Reward range will only be available for Product Transfers, with Further Advance requests limited to maximum 80% LTV – in line with our current Residential Remortgage product range. For more information and details on these product changes, please view our rate overview document.

Please also see below for key timelines for when products are being launched and withdrawn.

New Buy to Let Product Highlights available for remortgage only

- 1.86% 2 Year Fixed, £1,795 product fee, 75% LTV, Min loan £35k, Max loan £500k

- 2.19% 5 Year Fixed, £1,795 product fee, 75% LTV, Min loan £35k, Max loan £500k

- 2.55% 2 Year Fixed, £0 product fee, 75% LTV, Min loan £35k, Max loan £500k

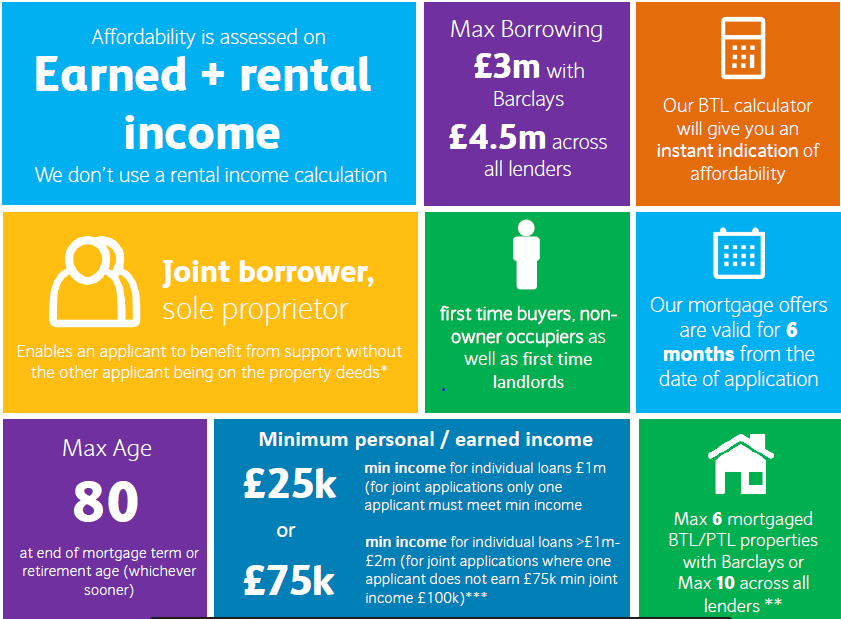

Why choose Barclays for Buy to Let?

Please view our new Intermediary and Reward range rate sheets.

Key timings*

- Existing products: Final date for generating a Mortgage Information Sheet (MIS *: Wednesday 6th May, 2020

- New products available: Thursday 7th May, 2020

- Last Rate Switch applications (Product Transfers): Thursday 7th May, 2020

Last Further Advance applications: Friday 15th May, 2020

*Applications on an existing product

To qualify for a product, a MIS needs to have been generated, on or before the date of withdrawal (Wednesday 6th May), either using our Barclays systems or your preferred sourcing tool. The application is also required to have been successfully submitted prior to the last application date – Thursday 7th May for Product Transfers and Friday 15th May for Further Advance.

Please be advised that upon withdrawal, the products will be removed from the dropdown options within our new lending application services. Therefore, you will need to ensure the product has been selected and saved in the application today.

Thank you for your ongoing support