Protection Update 17th September 2021

Hello everyone and welcome to this protection update – Friday 17th September 2021

I mentioned last week that there’s a lot happening in the protection industry and I’m not joking… It’s starting to kick off but in a good way. So, I’m going to keep this protection update relatively concise, but first… drumroll please…

MoneyFacts Awards – Protection Adviser of the year 2021

Last night was the MoneyFacts down in London and we had not 1 but 2 of our adviser firms from within the Right Mortgage & Protection Network shortlisted for the Protection Adviser of the year award.

They are ‘Strathon Park’ and ‘Weystone’ – and it was an incredibly strong lineup. I know some of those other firms nominated.

Well done to Miles and the team at Strathon Park and also Ash and the team at Weystone. That’s amazing industry recognition about advice excellence and Weystone picked up the ‘Highly Commended’ award. Congratulations from all of us at The Right Mortgage & Protection Network.

Now Ash Lee James has also been nominated and shortlisted in the Black British Business Award.

Now these BBBA awards are pretty high profile and have going for a few years now, and looking at the website, all the major political leaders have written endorsements including the current prime minister, Boris Johnson.

Now if you look at the Awards categories; it’s not just financial services, but all business including arts and media, consumer and luxury, entrepreneurs, education, professional services and of course financial services.

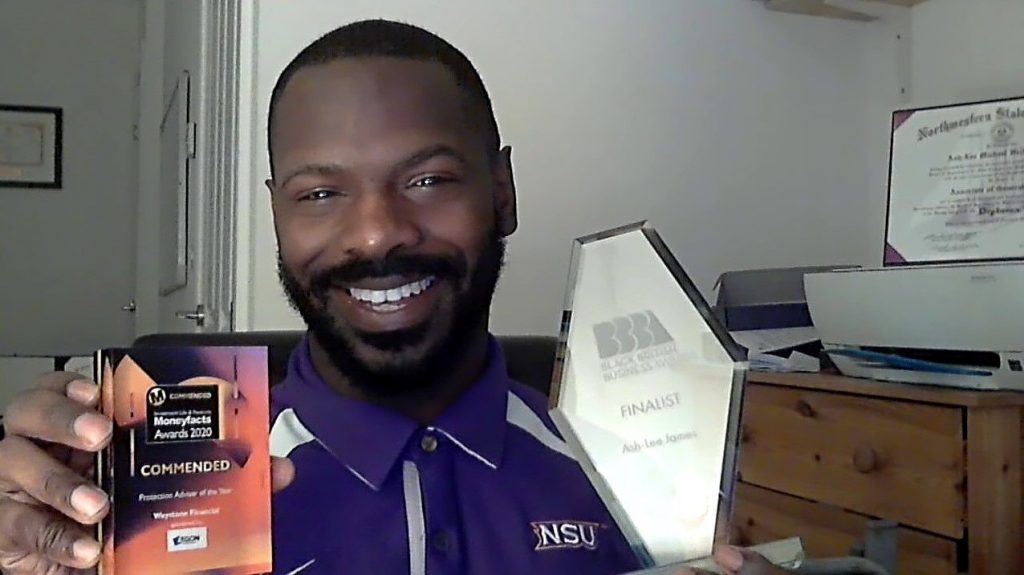

Ash is one of just 3 finalists in the Financial Services Rising Star category – which is just phenomenal. Fingers cross you win it, but really; well-done Ash! What a great piece of recognition for you and your team down at Weystone!

Here’s a photo of Ash with both of his trophies!

Protection Insight Podcasts – Trusts – Legal & General & Letter of Wishes

Now this week marks the last of our Trusts podcasts and it’s with Legal & General.

So, a few days ago, I sat down with Thomas May who is one of their life technical specialists who walked me through their digital trust process.

I think this is very unique on the marketplace because it’s a PDF that requires no signatures from anybody.

That means you can get the job done really quickly.

Watch the “Writing a Life policy into Trust with Legal & General” Protection Insight Podcast Now >>

And also, some of you have been asking me about the ‘Letter of Wishes’ podcast?

I actually released that a couple of weeks ago when I was on holiday and it was stitched to the protection update which means if you only read it (rather than listened to it), you might have missed it.

Watch the “Letter of wishes” Protection Insight Podcast now >>

So, I’ve added the link above and it’s also in the Podcast Library – we are starting to get quite a collection.

Income Protection Awareness Week – all next week (20th to 24th Sept)

I mentioned it last week, but this is the last call to action; next week is income protection awareness week. What does that mean?

Well, the IPTF are running webinars every day at 12noon until 1pm and it’s in an attempt to get the whole industry refocused on putting income protection firmly on the agenda.

- Monday 20th (day 1) will be an introductory session called ‘the importance of income protection’. There will be lots of case studies and real-world reasons why it really is important to not ignore it.

- I predict that Tuesday 21st (day 2) will be the most relevant day for advisers in our network because the session is entitled “Income Protection and Mortgages”. I will kicking that off session with the key note speech and my argument which is “Why mortgage clients need you to talk to them about Income Protection”. It would be good if you could join me!

- Wednesday 22nd (day 3) is called “Income Protection for Wealth Advisers”

- Thursday 23rd (day 4) should be a good session called “Underwriting and Claims – Myth busting and sharing experiences”

- And then the final day, Friday 24th is a call-to-action session called “Time for Action; pledge time and next steps”

If you’re passionate about protection, it really would be great if you could come along to one or two of these webinars and I’ve added the registration link to this protection update. When you click on the link, you will be able to select whichever dates you wish to attend.

One more thing… When you register, make sure that the link is added to your calendar from 12noon to 1pm. When I did it, my calendar invite actually said 1pm, but if you try to join at 1pm; it will already be over.

Each session is at 12noon everyday next week!

Legal & General – Key Person Income Protection

Talking about Income Protection, this week saw the launch of a brand new ‘Key Person Income Protection’ product from Legal & General.

There aren’t too many of these on the protection market but it’s a very welcome addition.

What is it?

Well, it’s income protection which means if the insured person is unable to work due to sickness or accident… Instead of the claim going to the person who is incapacitated; it goes to the business.

This is business protection. The business takes out cover on a key person to protect the profits of the business if that key person goes off work sick.

Legal & General say this product “It’s designed to help small businesses move confidently through any financial uncertainty that can occur if a key employee needs time off work due to absence”.

And there are some specific examples of exactly how this type of cover can help a business whether its:

- To meet the cost of hiring a temporary replacement

- It can protect up to 75% of gross profit (that can be attributed to the contribution of the key person) and this will be paid monthly – as per income protection

I’ve added a link to the landing page where you can get more of the detail and download all the literature for key person income protection.

Better Sick Pay Schemes

We will be launching our own Income Protection campaign at the end of the month and it’s called “Better Sick Pay Schemes” and will start with some online workshops that you will now be able to register for right now.

These are:

- Monday 27th September – click here to register

- Wednesday 29th September – click here to register

- Wednesday 20th October – click here to register

These will all start at 10am and run until 12noon and we’ve invited various providers to support these workshops, plus, there will also be lots of other content related to the campaign each Friday via my protection update.

And one more thing, these will be CPD events, so just click on the links above and you can start registering for these events!

iPipeline – Income Protection workshops

And finally, a few more webinars to let you know about.

iPipeline will be running a webinar (to support income protection awareness week with 2x webinars next week.

The first is on Monday 20th September at 10.30am with a session called – What is Income Protection?

Monday 20th September at 10.30am – Register here

Then the second webinar they will be running is on Wednesday 22nd September next week and this one is an ‘Income Protection Product School’, so that will be more provider and technical specific.

Wednesday 22nd September at 10am – Register here

Scottish Widows – Underwriting Webinar

And finally, next week, there is a CII accredited Expert Series webinar from Scottish Widows called, ‘Our take on… Underwriting – the past, the present & the future’ on Wednesday 22nd September at 2.30pm.

Scottish Widows say that “this session will build adviser’s knowledge of some of the most common medical conditions to help improve their discussions with their respective clients”.

The webinar will be led by Dan Musty, Underwriting Development Manager, who will provide an overview of how we enable customers with Mental Health issues to access insurance and break down the stigma; how COVID changed the underwriting landscape.

Scottish Widows – Wednesday 22nd September at 2.30pm – Register now >

So, with that, I’ll sign off and wish you all a super weekend!