Link to Protection Guru Article – https://protectionguru.co.uk/when-do-insurers-apply-smoker-and-ex-smoker-premium-rates/

Hi everyone and welcome to this week’s protection update – Friday 18th March.

This week we’re going to carry on the underwriting theme by way of looking at some of the resources which are available via Protection Guru.

A few months ago, Tim Layton-Hyslop from Marchington White got in touch to ask a query about smoker rates. He wanted to know specifically about providers who classify vapers as smokers.

Now that got me thinking that there are differences on the marketplace but how could you find out exactly what everyone does.

For example, which providers don’t have separate smoker rates? Some don’t.

Which providers only look at nicotine vapes as smokers?

There are going to be different attitudes from different providers and that would be good to understand so you’re able to factor it into your advice and recommendation.

My first port of call with a query like this would be to go to Protection Guru. However, this wasn’t a piece of research they had previously carried out, so I asked the question; is this something you can take a look at?

And the answer was yes. And Robert Harvey from Protection Guru has just published a protection research piece into the subject of Smoking.

And this coincided with No Smoking Day 2022 which was last Wednesday.

So, what were the findings in the report…

Protection Guru Report – When do Insurers apply smoker and ex-smoker premium rates?

Rob starts his report by giving some context.

He says that in the context of protection insurance, the smoking status of a client can have an impact both on the premiums they pay, as well as underwriting outcomes, if for example smoking is disclosed alongside other health conditions.

We can appreciate that whilst the number of people smoking is declining year on year, there are still thousands of current and ex-smokers out there, so every adviser is likely to encounter clients who smoke on a fairly regular basis.

Understanding how the clients smoker status can impact premiums will be important for setting cost expectations, but may also be a factor in determining recommendations.

Of particular importance is also the fact some insurers now charge a slightly higher premium for ex-smokers, who quit more than a year ago and who in the past may have been classified as a non-smoker.

As far as we are aware, none of the quotation portals currently offer ex-smoker as an option on the client details input section and instead just offer a binary ‘yes’ or ‘no’ response option.

This means that if the client is an ex-smoker and the adviser selects an insurer who applies ex-smoker rates, they may discover the premium is higher only once an application is submitted on the insurers portal, unless of course this is investigated prior to applying.

What are the health risks associated with Smoking?

Rob then goes on to look at the underwriting risks that various types of smoking.

Current Smokers

“Smoking increases the risk of many health problems and diseases. It is now linked with at least 15 cancers, including two of the most common; lung and colon.

It is also known to cause problems with the heart and circulation (e.g., heart attacks, strokes) and also lung damage, such as COPD (chronic bronchitis and emphysema) and pneumonia.”

That means a higher risk to the insurer, you can expect to pay a higher premium.

Ex-Smokers

If we look at Ex-Smokers. So that means people who don’t smoke anymore but used to…

Rob Reports “The health risks associated with smoking do not sudden vanish overnight on stopping smoking. This takes time to reduce, and differs with various diseases.

- Between 1-5 years – the risk of heart attack drops significantly

- 5-10 years- Cancers of the mouth, voice box and throat will have halved by this point

- 10-15 years- Lung cancer risk will have halved by around this point.

- 15 years- The risk of heart disease is now fairly close to that of a someone that has never smoked.

Vapes

And finally let’s look at Vaping; which was the question Tim first asked originally which led to this report…

“There is still uncertainty about the long-term health implications. It is known that long term exposure to nicotine alone does not increase rates of cancer, or heart and lung disease significantly. This has been previously demonstrated in studies on conventional nicotine replacement products.

There are also no tars, oxidant gases or carbon monoxide in vaping products, that are known cause health problems. The risk to the heart and blood vessels from vaping are currently unknown, but it is thought to be far lower than cigarette use.

As with any new product though, the long-term consequences are largely unknown. It is thought that there is still a possibility that certain toxic and carcinogenic compounds can still be present in these devices.

In 2019, the CDC in America reported 2,000 cases of severe lung illnesses that were suspected of being linked to vaping devices. There were worries that this may have been contribute to by informal or illicit devices being used. The exact cause is yet to be determined.

Finally, although there is evidence that they can be used effectively to stop smoking, there are still some public health concerns, particularly in children where it may be seen as a gateway to future tobacco use.

Which providers do not apply Smoker Rates?

From a protection perspective, if you have a client who is a smoker; which life offices do not apply rates for smokers?

Here you’re looking at British Friendly, Cirencester Friendly and LV= (Personal Sick Pay IP only) do not apply smoker rates which effectively means two identical clients applying for cover but where one is a smoker; they will pay exactly the same premium.

We do need to caveat that this is based on the providers that shared data with protection Guru; not all did.

Now as you would expect with Protection Guru; they didn’t just leave things there. They actually did a deeper dive and the next thing which was really interesting was when we ask the question “what is a smoker”?

What is classified as a smoker?

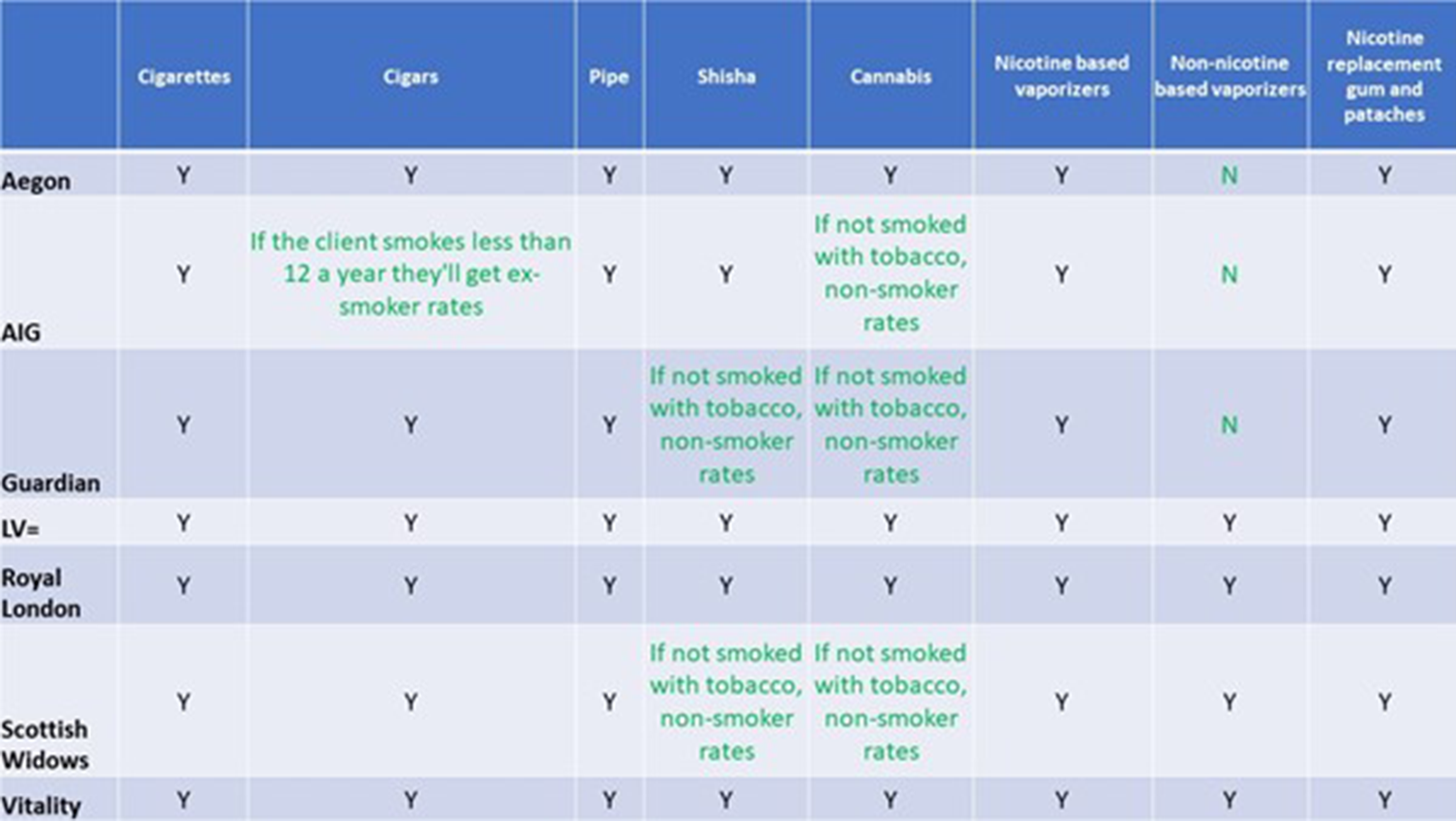

Now for the purposes of this weekly update, I’ve added the graphic from the Protection Guru report both into the transcript and into the podcast itself.

If you take a look at the table every provider on this list classifies cigarettes as smoking. You would expect that.

But this handy chart does reveal some interesting things beyond that.

Cigars

For example, AIG is the only life office which if your client smokes Cigars and let’s say the client smokes less than 12 a year in total. They would be classified as an ‘ex-smoker’

Shisha.

Let’s talk about Shisha. Most providers consider someone who uses Shisha as a ‘smoker’. But Guardian and Scottish Widows will classify the client as a non-smoker if the Shisha is not smoked with tobacco.

Cannabis

If you have a client who smokes Cannabis; are they a smoker? Well, they are with most providers but again, if the smoking doesn’t contain tobacco, then AIG, Guardian and Scottish Widows would give you non-smoker rates.

And then let’s talk about Vapes.

Vapes

If your client smokes a nicotine based vape, then all providers who feature in this research report (which is Aegon, AIG, Guardian, Liverpool Victoria, Royal London, Scottish Widows and Vitality); they all classify the client as a smoker.

But what about if the client smokes a non-nicotine based vape? That’s where the original query came from and it seemed there was some grey area.

Non-Nicotine based Vapes

Well, Aegon, AIG and Guardian will classify your client as a non-smoker, if the vape does not contain nicotine.

And one final thing to pull out of the report is that there doesn’t seem to be any leeway in terms of clients who are trying to give up smoking by way of using nicotine replacement gum or patches. If they are using those things, then they are classified as a smoker.

Ex-Smokers

As I mentioned earlier, the new category of Ex-Smoker is becoming more popular amongst providers so the next part of the report did a piece of research into that.

The upside of applying ex-smoker rates is that in theory those insurers can now offer better rates to clients who have never smoked at all, because that pool of applicants will no longer include clients who have smoked within the last few years and therefore still pose a risk.

The downside of course is for clients who have quit smoking will still have to pay a higher premium.

Rob mentions that comments from their doctor highlighted there are still health risks for clients who have only recently quit smoking.

So, from the insurers who have shared data with Protection guru; AIG (only on their life and critical illness products, but not IP) and Guardian apply ex-smoker rates, as do Zurich, however they were not able to provide as with the specific details (this fact is published in their underwriting guide).

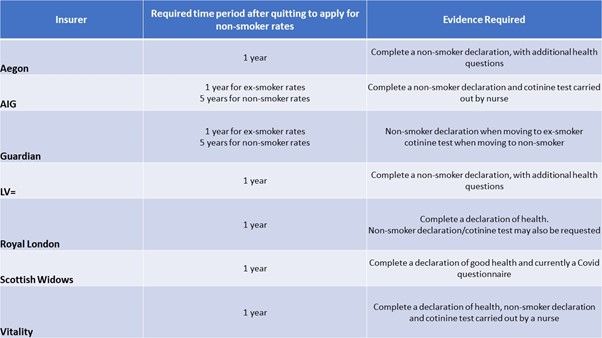

If the client quits smoking; can they apply for non-smoker rates?

So, in this next section, Rob looks at each life office to find out if the client quits smoking, can they apply for non-smoker rates?

For those insurers who apply current or ex-smoker rates, clients will have the ability to re-apply for non-smoker rates if they quit entirely or the required period of time passes since quitting.

To help with this, Rob has added another table (and I’ve added it to this week’s protection update and the podcast itself.)

And finally, on the subject of Protection Guru I wanted to say a big thankyou to Matt Moore from the Right Broker.

Recently, Protection Guru have scored all the protection providers and products with their gold, silver bronze awards and this was recently published and is in the public domain.

However, what Matt has done is collated all the information into an interactive document so that you can find the information you’re looking for, really quickly.

I’ve attached Matt’s document to this week’s protection update. Just click on the C in the top left corner of every page to return to the main navigation page.

Link – Protection Guru Roundup from Matt Moore

Don’t forget the roadshows which are starting next week. We do still have spaces so I’ve added the registration links to this week’s protection update. I hope to see you there.

Register for the March roadshow here.

And that’s it from me for another week.

Thankyou to Rob Harvey from Protection Guru for the insight piece on smoking – very much appreciated.

Have a great weekend and ill speak to you soon.