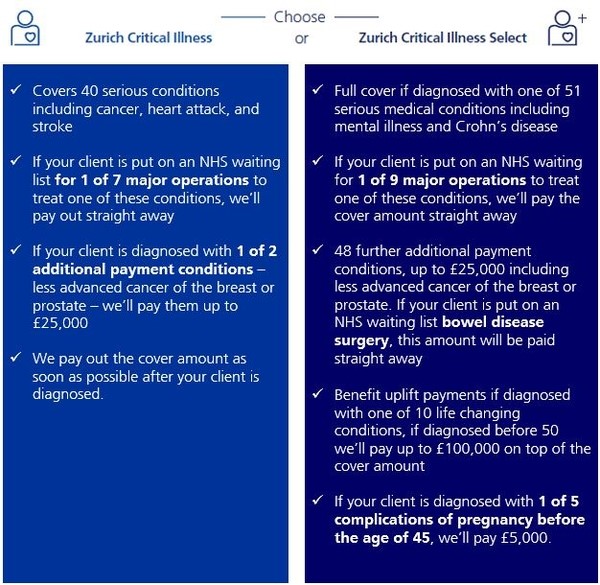

Taking out Zurich Critical Illness or Zurich Critical Illness Select will help you support your client through life’s ups and downs. Select is the most comprehensive level of cover we offer. Your clients can choose to add Critical Illness Select when they take out their critical illness cover.

Optional extras

- Children’s Benefit – they will be covered for the following:

- Covered for 42 conditions under critical illness

- Covered from birth until their 22nd birthday

- £5,000 children’s death benefit (from 30 days to 22nd birthday)

- Each child can take out a policy of their own up to £25,000 of cover after their 16th birthday free of underwriting

- Enhanced Children’s Benefit –If your client chooses Critical Illness Select, in addition to what’s covered under Children’s benefit, your client will also have:

- Cover for 99 conditions under critical illness select plus 6 child specific conditions

- Double the child’s benefit amount up to a maximum of £50,000 if the child is diagnosed with cancer or requires overseas treatment for any of the covered conditions

- £5,000 children’s death benefit (from 24th week of pregnancy to 22nd birthday).

- Multi-fracturecover

- You can also add multi-fracture cover to your client’s Zurich Critical Illness policy at any time. If your client breaks a bone, dislocates a joint, ruptures their Achilles Tendon or tears a cruciate ligament in their knee, we could pay them up to £6,000 each policy year, the cover is non-underwritten.

To find out more, please contact your usual Business Account Manager or visit the Critical Illness page on our Zurich Intermediary site.