The question of whether to borrow through a limited company structure is one which all landlords have faced and continue to face. Considerations must be taken over the landlord’s number of properties, future plans, financial circumstances and exit strategies. Elements which also point to the importance of a good, professional mortgage advice process, as well as separate tax advice.

With all this in mind, let’s take a look at data from the latest BVA BDRC Landlord Panel research for Q3 2021 to gauge how landlords are currently approaching limited company lending.

The research outlined that almost one in five (17%) of landlords hold at least one of their properties as part of a company; this rises with portfolio size with 63% of 20+ property landlords holding some or all of their portfolio in a Ltd Company.

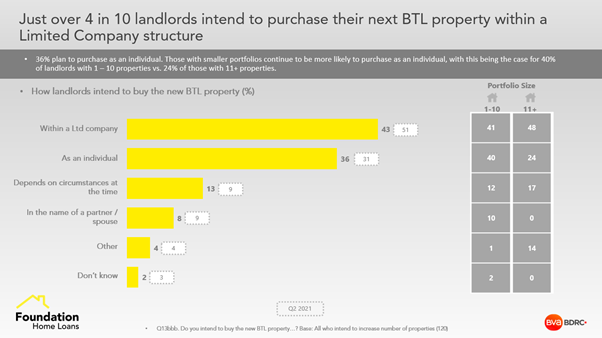

In addition, just over 4 in 10 landlords intend to purchase their next BTL property within a limited company structure whilst 36% plan to purchase as an individual. Those with smaller portfolios continue to be more likely to purchase as an individual, with this being the case for 40% of landlords with 1 – 10 properties vs. 24% of those with 11+ properties.

When considering a lender in this area, intermediaries need to ensure that they are looking for ones with transparent mortgage products, consistent lending decisions, excellent customer service and expertise in limited company lending.

Do you have landlords buying or remortgaging within a limited company structure? Contact Foundation Home Loans today.